2021 Farmland Outlook: Buckle Up for a Dynamic Market

Key forces are converging to send farmland values higher — maybe even to historic levels. After years of stable prices, be ready to see your asset soar.

What is driving the farmland market?

- Government support for farmers (ex: Market Facilitation Program and Coronavirus Food Assistance Program payments)

- Stronger commodity prices.

- Low interest rates.

- Limited farmland for sale.

- Strong investor interest.

“Right now, those factors are all driving farmland prices higher,” says Doug Hensley, president of real estate services for Hertz Farm Management in Nevada, Iowa. “We’ve sold more $12,000 to $14,000 per acre farms from September to December than the last three or four years combined.”

When the COVID-19 pandemic caused shutdowns and stay-at-home orders in the spring of 2020, the land market ground to a halt, says Randy Dickhut, senior vice president of real estate operations for Farmers National Company in Omaha, Neb.

“Buyers and sellers just both pulled back out of caution and uncertainty,” he says. “Then in the summer, the land market started getting active again, and we saw increased interest in land of all types.”

Dickhut says sales activity for his company was up 49% in October and November versus the same time in 2019.

“Some investors came to the land market for the first time,” he says. “They wanted a safe, long-term investment to park some cash.”

Because of its stability and consistent returns, farmland got on the radar of all types of investors, adds R.D. Schrader, president of Schrader Real Estate and Auction Company in Columbia City, Ind.

“We’ve had everyone from small investors just looking to buy a 40 on up to the institutional-type investors,” he says. “I think COVID, in general, helped the land market.”

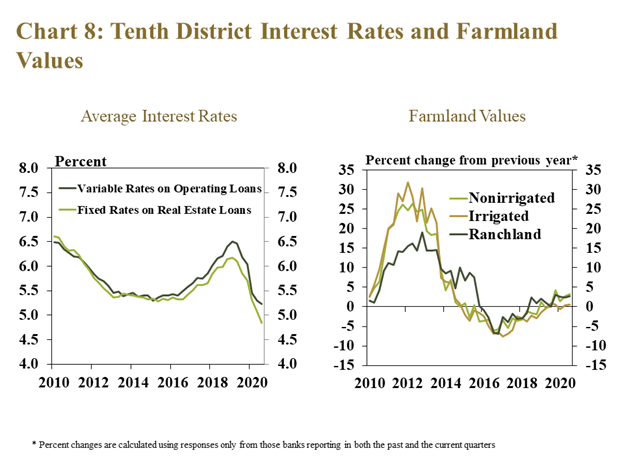

Perhaps the biggest factor driving farmland values higher is low interest rates. Currently fixed rates on real estate lows are at historic lows. For example, the Kansas City Federal Reserve reports average interest rates for farmland at 4.85%. The Chicago Federal Reserve reports rates have fallen to 4.24% for farm real estate loans.

How do these falling rates play out in the real world? For example, you bought a farm a year ago with the goal of having a monthly payment of $426 per acre. Interest rates drop by 200 basis points, which is similar to what happened in 2020. Today you can buy the same farm and pay $1,300 an acre more and still have the same monthly payment — just based on the drop in interest rates.

“That’s the power of cheap money,” says Steve Bruere, president of Peoples Company in Clive, Iowa.

Bruere is bullish on 2021 values. He says prices could even return to the record levels seen in 2013. As a reminder, farmland values in Iowa hit $8,716 per acre, according to the Iowa State University Farmland Value Survey. In 2020, the state average for all quality of land was estimated at $7,559 per acre.

“You have an environment where you have low interest rates, good farm profitability, strong farmer and investor interest and limited supply,” he says. “It is shaping up to be a dynamic market.”

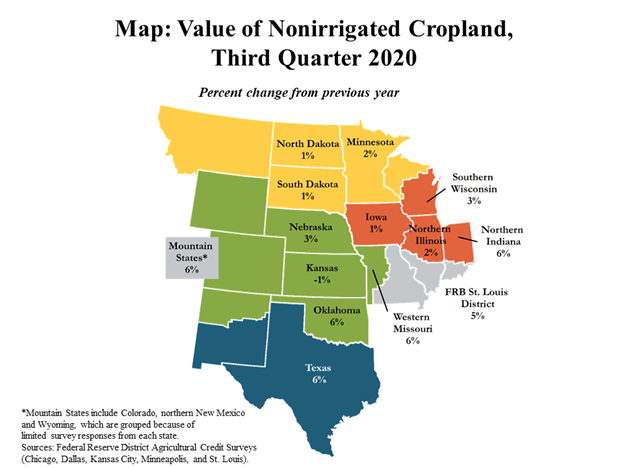

Farmland values generally remained strong across all regions. Values for non-irrigated cropland increased or remained stable in all reporting states and districts, according to Federal Reserve reports.

Read More from AgWeb's 2021 Outlook Series

Run With the Bulls: Take Charge of Your Crop Mix, Marketing

2021 Soybean Outlook: Low Carryover, Higher Price Boost Acreage Projections

2021 Beef Outlook: New Challenges, New Opportunities

2021 Outlook: Is the Stage Set for $5 Corn in the New Year?

U.S. Pork Outlook: Will 2021 Be Different?

2021 Milk Price Outlook: Throw the Crystal Ball Out the Window