Consumers Find Comfort in Ice Cream and Butter During Pandemic as USDA Shows Dairy Demand Hit New High

U.S. Farm Report 10/02/21 - Farm Journal Report Dairy Demand

Dairy demand continues to be a bright spot for the dairy industry. While climbing inputs costs, inflation and labor woes continue to mount, demand has been the one constant for dairy farmers not just the past 12 months, but even after the onset of restaurant restrictions due to the COVID-19 pandemic.

Just this week, USDA provided an updated look at domestic dairy demand, showing during the pandemic shoppers found comfort in dairy products like butter and ice cream. The switch in demand helped cushion the shift from the sudden loss of restaurant demand at the start of the pandemic.

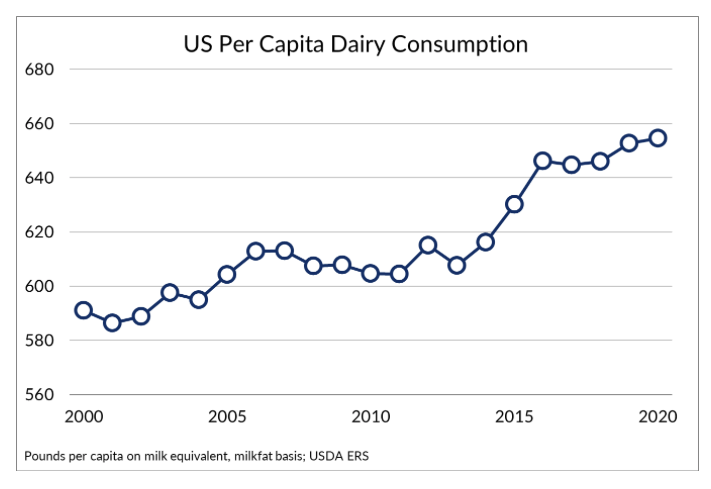

“We beat expectations,” says Matt Herrick, senior vice president of communications, International Dairy Foods Association (IDFA). “I think the expectations were (that) consumption would be down or consumption would be flat. Well, when we look at the consumption data that USDA released yesterday, it is really outstanding as we saw the average American consumed three more pounds of dairy products across all segments in 2020.”

Dairy is Delivering

USDA’s Economic Research Service (ERS) shows in 2020, the average American consumed 655 pounds of dairy products, which is 3 pounds more than the previous year. And the added consumption isn’t coming from traditional fluid milk sales, but products like yogurt, butter and ice cream.

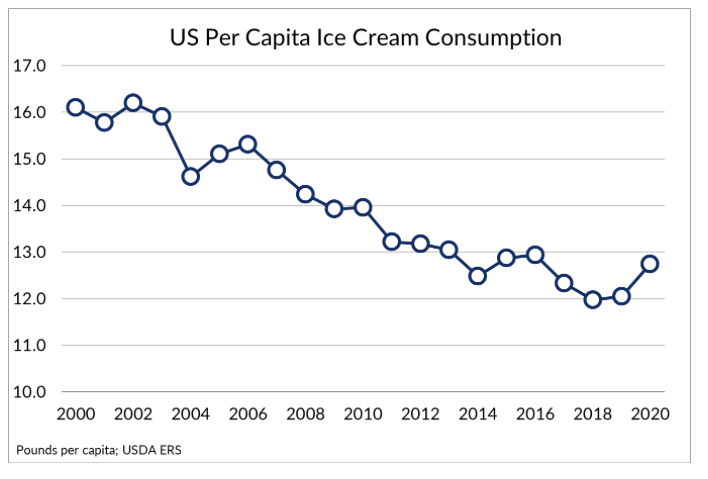

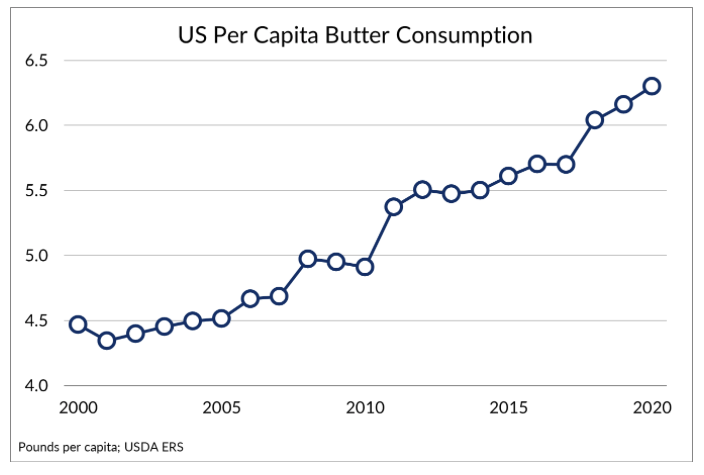

“There were some months when we were selling 30% more ice cream at grocery stores and 20% to 25% more butter,” says Herrick. “That's where we saw different segments in the industry pull some of the other segments forward. So, milk was flat, and cheese was flat, and cheese has been the big driver of consumption for a few years. But in 2020, we saw butter driving consumption; it's up 3%. We saw ice cream, which had been flat for a few years, driving consumption up 6%.”

ERS data show that, overall, dairy consumption continues to climb higher, which is a sign of healthy demand for the U.S. dairy sector at a time when dairy demand continues to hold its own in the overall milk price picture.

“Dairy is delivering,” says Herrick. “And dairy is different in terms of how we're consuming our dairy. We used to drink a lot more dairy a generation ago, and today, we eat a lot more of our dairy. We do that with ice cream and cheese and yogurt, and with some of those other segments. It's really just outstanding news for the category overall for producers and processors and anybody involved in the industry."

COVID-19 Concerns

Even with an uptick in COVID-19 cases across the country recently, the concerns about domestic demand haven’t solidified yet.

“Consumers are spending about as much as they were spending pre-pandemic at restaurants, and service industry places, bars, restaurants, that kind of thing,” says Jackson Takach, chief economist for Farmer Mac. “So, we're back in terms of total dollars, but it's not the same across the country.”

Sporadic setbacks due to increased COVID-19 restrictions have also created some issues with sporadic demand.

“In the country, I think demand is fairly solid, but it'd be nice if our economy (wasn't) so disjointed. By that, I mean one city opens up the restaurants and then they back off a bit due to restrictions or some social distancing,” says Jim Ostrom of Milk Source.

Release Valve from Demand

Even with concerns about restaurant demand possibly tapering off again, dairy demand is still a bright spot with dairy exports continuing to show strength.

“It's really supported markets so far this year, coming through the entire time,” says Ben Laine with RaboFinance. “Really, since the beginning of COVID, we saw exports surprisingly strong. And that's been a real bright point and really helped us as we moved out of 2020, where government intervention, some of the food box purchases, a lot of government support really helped support markets here in the U.S.”

“You have that release valve and that's going to be export markets and then more consumption of fluid milk all across the country, as we've seen schools reopen as we've seen some restaurants reopen,” adds Takach. “I think that's been a nice release valve for the dairy sector as well.”