About-Face

A growing number of producers change course with the future in mind

Later this spring, those 160 acres—normally devoted to corn silage and wheat—will be sprouting young almond trees.

|

California dairy producer Melvin Simoes is converting 160 acres of cropland into almond orchards. As part of the $1 million transformation, pipelines are being buried underground to deliver water to the trees by drip irrigation. |

Although he’s never grown almonds or any other crop besides feed for his dairy, Simoes has embarked on what he calls a "nerve-wracking but exciting" venture.

"Dairying is not what it used to be," says Simoes, 49. "I want financial security. I want to leave my children something they can manage."

Simoes is one of a growing number of U.S. dairy producers who have stepped outside of their comfort zones to secure their future. Some are diversifying into lucrative crops such as almonds, walnuts and pistachios. Others are branching into retail and marketing their own dairy products or expanding their dairy operations into other states.

Driving these makeover efforts is a desire to capture profits that will enable them to remain in production agriculture. For nearly five years, dairies have struggled as soaring production costs, especially for feed, have led to low or even red-ink margins. Even with 2013’s rebound in milk prices to $20 per cwt., many dairy operations remain burdened by heavy debt loads. Social and regulatory pressures also are squeezing dairy production.

"Since 2009, the numbers have just not been lining up," Simoes says. "I was in denial of just how bad it is. Even some of the top dairymen are going out of business. I would love to stay in the dairy business, but I had to have a secondary plan."

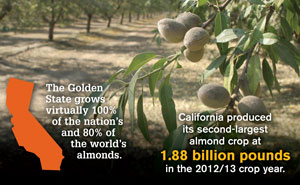

Almond Craze. In California farming circles, it’s hard to ignore the success of almonds. The Golden State grows virtually 100% of the nation’s almonds—and 80% of the world’s supply. During the past crop year, California produced its second-largest crop at 1.88 billion pounds, according to the Almond Board of California. In 2013, the state’s almond acreage with producing trees reached an all-time high of 810,000. Only forage takes up more acreage in California.

Growing global demand for the nut has absorbed the increasingly larger crops, and prices have remained strong; 2013’s farm-gate price for almonds rose to $2.58 per pound, the second highest in 10 years. For dairies, almond’s are also attractive because the orchards use less water than feed crops and don’t come with manure management regulations. The nut harvest occurs once a year—not every day. Unlike milk, almonds can go straight to storage for shipment as needed.

"Most land being sold [in the San Joaquin Valley] is being purchased by people who intend to plant trees or some type of permanent planting," says Cornell Kasbergen, who owns a large dairy near Tulare. "I have had some dairymen tell me that for the dairy to compete with permanent plantings, milk would have to be well over $25 per cwt."

Robert Matlick, a partner with the California-based CPA firm of Frazer Frost LLP, offers business consulting services to agriculture, mostly to the western dairy industry. He named several San Joaquin Valley dairies that have expanded into permanent crops. Many others are watching or intend to do the same.

|

Water Shortage. Simoes’ revelation about the vulnerability of his dairy’s future hit him this past summer while driving past his neighbor’s pistachio orchard. There, Simoes saw irrigation drip lines precisely delivering water—California’s most embattled natural resource—to each tree. Glancing to his right, he saw his own corn silage field, flooded 2' deep to irrigate the crop in the triple-digit temperatures.

"That was the kicker for me," Simoes says. "In the dairy business, we can buy a lot of what we need, but not water. The days of ample water are going to be gone."

In the past two years, Simoes has downsized his milking string from 1,700 cows to 1,500. His 48 milking machines allow him to milk the herd three times a day, so his milk production remains high. But fewer cows left him with excess feed.

Both his banker and accountant support his decision to diversify into almonds. But the ultimate approval came from his father, Mario, a longtime dairy producer. "That was the moment I knew it was time to start digging the holes," Simoes says.

Luckily, Simoes’ expansion into almonds didn’t require him to purchase more land, now priced at $14,000 per acre. Instead, he’s developing two of his own fields, where sampling indicated almond trees would thrive in the heavy soil. He invested close to $1 million into his almond venture and used his land as collateral, something he never would have considered before.

Walnut Groves. Some 15 miles north of Simoes, dairy producer John Mendonca is two years into growing walnuts. His dairy milks 600 cows and is home to 500 head of support stock. In the past few years, his ground dedicated to growing corn, alfalfa and winter wheat shrank from 900 acres to 500 as he watched his rental ground get sold. His decreased acreage forced him from being a self-sufficient feed grower to buying almost half of his alfalfa needs.

|

John Mendonca of Tipton, Calif., will harvest his first walnut crop in late 2017. This dairy producer’s only regret: "I should have done this five years sooner." |

"I had been planning on expanding the dairy, but with the low profit margin due to high input costs, I felt expansion would not be the best solution," Mendonca says. "After consulting with some close neighbors, they felt I was a good candidate to diversify into a permanent crop. They explained to me what return on investment to expect. The ground I already own is ideal for walnuts."

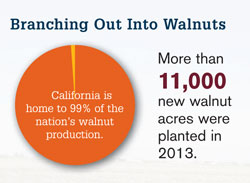

California is home to 99% of the nation’s walnut production. More than 11,000 new walnut acres were planted in 2013, contributing to a crop that has nearly doubled in 10 years. The 2012 crop yielded a record average price of more than $1.52 per pound on finalized contracts.

Ready to diversify into walnuts, Mendonca had to decide how much land to take out of feed production for the new orchard. He consulted with his banker, weighing walnut costs and revenues and comparing them to the dairy’s feed loss. After calculating costs for converting to an 80-acre walnut orchard, his banker agreed to a development loan.

Mendonca’s walnut expansion cost $121,000. He did some work, such as land laser-leveling and tree pruning, with family help. The single biggest expense was $93,000 for 6,000 grafted walnut trees.

Now in his second year of production, Mendonca has only one regret. "I should have done this five years sooner," he says. "Walnut prices hit another all-time high this year."

|

It will be several years before these producers can gauge their ventures’ success. Mendonca won’t harvest his first walnut crop until fall 2017. He hopes to gross 400 lb. to 500 lb. per acre.

Simoes won’t know for five to 10 years if his almond venture will be worth it. By the fourth year, his investment will have grown to $2 million. "Year four is when I should start seeing my return on investment," Simoes says.

He is hopeful. "With a dairy, the phone never stops ringing," Simoes says. "I look at my neighbors with tree crops, and it’s so peaceful. I hope the trees give me that."

|