Dairy Outlook Yields Uncertainty

Much will depend on whether exports rebound

Coming off record milk prices in 2014, the new year can only promise declining prices, lower profits and heightened uncertainty.

There is some good news, however: Lower feed prices in 2014, most notably corn and soybean meal, are likely to continue this year. Cottonseed has also been a bargain, due to a 25% jump in the national yield resulting in 10% to 15% lower prices.

In addition, better hay crops east of the Rocky Mountains mean forage should remain moderately priced. In the Midwest, alfalfa has dropped to $200 per ton or less.

But California’s crippling drought, despite a moderate El Niño this winter and more snow in the Sierras, means hay prices continue to be high in the West. Dairy quality alfalfa still commands $300-plus per ton in California.

The biggest uncertainties for 2015 are global markets. Unlike 20 years ago when the U.S. exported about as much as it imported (3% to 4%), the U.S. now ships 15% of its milk.

In perspective, 15% equals exporting one day of milk production every week of the year. But it’s even more important than that, says Marin Bozic, a University of Minnesota dairy economist. Roughly three-fourths of every pound of increased milk production is exported. If exports slow, more milk must be consumed domestically, driving down prices until inventories clear.

A drop-off in exports coupled with a 3% increase in milk production could drop U.S. milk prices 25% to 35% this year.

Consequently, U.S. dairy farmers are keeping their eyes on three critical global market drivers: China, Russia and the European Union (EU).

“China is the dragon in the room,” Bozic says. “It front-loaded its dairy imports in the first half of 2014,” buying nearly 80% of its imports in the first five months of the year—more than the annual production of New Zealand, the world’s largest dairy exporter.

USDA expects China to cut back its purchases of whole milk powder as much as 12% in 2015, due in part to a substantial build-up of stocks from its huge buying spree this past year.

Russia is the second wild card in 2015. It stopped buying dairy products from the EU, the U.S. and Australia in retaliation for sanctions those countries imposed on Russia due to its Ukraine adventures.

“[USDA’s] 2015 forecasts assume the Russian ban will be lifted in early August, and China will continue to be a major buyer of whole milk powder, but at volumes near 2013 levels,” says Mary Ledman, dairy economist with the Daily Dairy Report and president of Keough Ledman Associates Inc., Libertyville, Ill. “At this point, neither of those are a given.”

The third leg of the 2015 uncertainty stool is the lifting of dairy quotas in the EU. Dairy quotas were imposed in 1983, locking many farms into a Rip Van Winkle-like slumber that lasted three decades.

Ireland and Scotland are poised to increase milk production by as much as 50% in the next decade. The

Netherlands, too, could increase output. But high land and labor costs and environmental constraints will limit growth in EU production. In Germany, nearly 75% of dairy farms have exited the industry since quotas were instituted, says Wilfried Wesselink, Dairy Today’s European contact.

The Russian choke hold on EU dairy exports means approximately 4% of EU milk must find new markets. Coupled with a 5% surge in milk production in 2014, European prices have declined as well.

This has some European dairymen calling to delay lifting quotas on April 1—which isn’t likely.

“The impact of the end of quotas is already here, and I expect more of a soft landing than a sudden explosion of milk production,” Bozic says.

While 2015 will be unsettled, hope remains that a rebirth in trade will end the year on a high note.

|

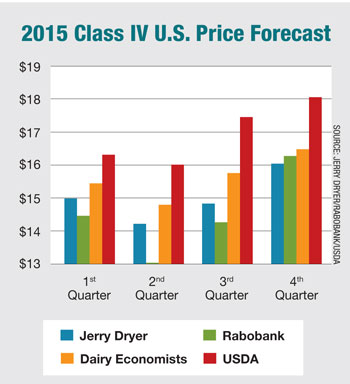

USDA presents the most optimistic outlook for Class IV milk powder prices. (Class IV prices are the highest correlated to world milk prices.) |

Go online to keep up with the latest dairy news from Jim Dickrell and his Dairy Today team. While you’re there, sign up for the free newsletter.

www.DairyToday.com