6 Reasons Why Southeast Asia Will Remain a Beacon for U.S. Dairy Exports

Already the second-largest market for U.S. dairy exports, the region is poised for more growth.

The 10-member Association of Southeast Asian Nations (ASEAN) is the second-largest market for U.S. dairy exports, trailing only Mexico, reports Mark O’Keefe of the U.S. Dairy Export Council (USDEC). In the last five years, sales have more than tripled in value to $1.3 billion.

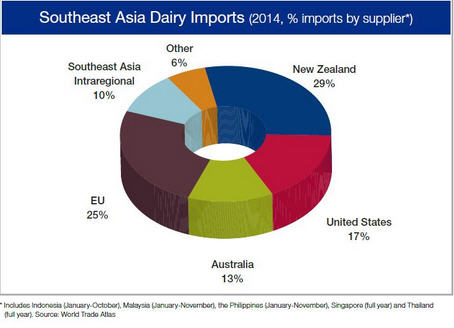

“Southeast Asia is probably one of the most dynamic dairy markets in the world,” says Singapore-based Tony Emms, regional director of USDEC’s Southeast Asia office. “This region does not produce much milk and needs imports.”

ASEAN includes Indonesia, Malaysia, the Philippines, Singapore, Thailand, Vietnam, Brunei Darussalam, Myanmar (Burma), Cambodia and Laos.

USDEC says six powerful trends are driving increasing demand for U.S. dairy exports to the ASEAN region:

- Booming population – In 2014, the ASEAN population was nearly twice the size of the U.S. By 2050, the region will be home to more than 830 million people compared to less than 400 million in the U.S.

- Steady economies - The International Monetary Fund projects strong and steady growth of 5-6% annually through 2019 for the six main target markets. That compares to just 3.4% for the world as a whole. Economic conditions are fueling middle class expansion and dietary shifts, says O’Keefe.

- Thriving food manufacturing industry – Spurred by reduced trade barriers and rising demand, local and multi-national companies are building capacity and investing in product development capabilities in the region. That expansion is not only servicing domestic ASEAN demand but exports to places like China, the Middle East and Africa. Those investments have created significant markets for high-value dairy ingredients made to tight specifications.

- Foodservice expansion – Cheese imports from the six major Southeast Asian dairy buyers have increased for eight consecutive years, O’Keefe notes. The area is poised for future growth. For example, Vietnam got its first McDonald’s and Starbucks just last year. “The outlets were an immediate hit,” says O’Keefe. “In a nation of 90 million, that is a lot of room for milk and cream for coffee and cheese for burgers.”

- Youthful demographics - Lifestyles in these increasingly urbanized nations are becoming faster paced. Time pressures and changing social habits have boosted the number of consumers looking for convenient foods that fit modern lifestyles. Populations skew young compared to Europe and the U.S.

- Healthier lifestyles - Often backed by government initiatives, Southeast Asian consumers have grown much more knowledgeable about dairy’s role in health and nutrition. Trust in dairy is driving people to incorporate milk, cheese and dairy containing products into their traditional diets. Functional foods are becoming more prevalent.

Challenges with free trade agreements and service demands need to be addressed, USDEC says. “But, taken as a whole, the outlook for U.S. dairy in Southeast Asia is bright,” says O’Keefe.