Global Dairy Trade Began to Slow in 2014

U.S. Dairy Export Blog

While dairy markets have fallen to multi-year lows this summer, the slowdown in global demand growth can be traced to last year.

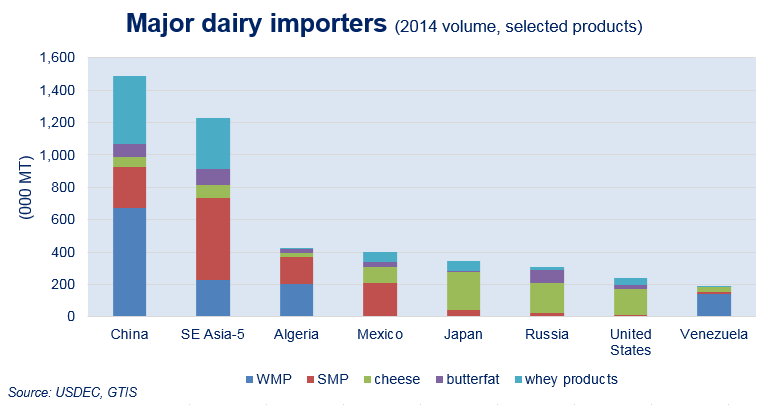

Imports of milk powder, cheese, butterfat and whey from eight of the top dairy buyers—representing a little more than half of total world trade—totaled 4.62 million tons last year, up fractionally from the year before. The flat performance comes after the group—China, Southeast Asia, Algeria, Mexico, Japan, Russia, United States and Venezuela—had posted gains of 8 percent per year for the previous five years, according to Global Trade Atlas data.

China’s imports—nearly 1.5 million tons last year—were up 6 percent from 2013, with huge growth in the first half of the year followed by large declines in the second half. Of this basket of products, China accounted for about 17 percent of world trade, including more than a quarter of the whole milk powder and whey products exchanged.

Southeast Asia (Indonesia, Philippines, Malaysia, Thailand and Singapore) imported 1.2 million tons, up 3 percent from the prior year. Malaysia and Thailand posted double-digit growth, while Indonesia and Philippines purchases declined. These five countries imported about a quarter of the traded skim milk powder.

Algeria imported 422,000 tons, up 38 percent from 2013. The vast majority of imports were milk powder, with Algeria accounting for about 16 percent of world milk powder imports last year.

Mexico imported 400,000 tons, down 2 percent. Mexico accounted for about 10 percent for world skim milk powder imports, and was the world’s fourth-largest importer of cheese and third-largest importer of whey products.

Japan imports totaled 343,000 tons, up 4 percent from the year before. Japan was the world’s largest cheese importer, accounting for more than 10 percent of world trade.

Excluding purchases from customs-partner Belarus, Russia imports dropped to 311,000 tons, down 37 percent. Imports dropped off in the last five months of the year after Russia banned dairy products from Europe. Still, Russia was the world’s largest importer of butterfat and second-largest importer of cheese last year, accounting for 8-10 percent of world trade for each.

The United States imported 238,000 tons, about the same as the year before. Of this selected basket of products, nearly all U.S. imports were cheese, of which the United States was the world’s third-largest importer.

Venezuela imports were just under 189,000 tons, down 15 percent. Most of Venezuela’s imports were whole milk powder.

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council is primarily supported by Dairy Management Inc. through the dairy farmer checkoff that builds on collaborative industry partnerships with processors, trading companies and others to build global demand for U.S. dairy products.