Global Dairy Market Rally Runs Out of Steam

by Alan Levitt, U.S. Dairy Export Council

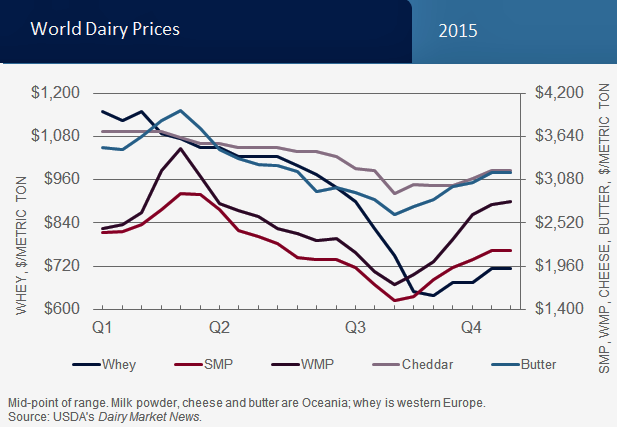

Global markets rallied in August and September, as fears of supply shortages out of New Zealand brought buyers off the sidelines to re-stock their cupboards at bargain-basement prices. After slumping to levels unseen in more than a decade, world benchmark milk powder prices increased 40-60 percent from their summer lows. But as USDEC forecast earlier, the rally has proven to be more of a correction from prices that went too low this summer rather than a sustained recovery, according to USDEC’s new issue of Global Dairy Market Outlook (pdf download). Prices remain well below long-term averages and in recent weeks they’ve pulled back again in the face of an oversupplied, buyers’ market.

In this competitive environment, U.S. dairy exports are lagging in 2015 (pdf download) In the first three quarters of 2015, U.S. shipments are down 27 percent by value and 9 percent by volume vs. the prior year.

The key factors necessary to deliver better market balance—production contraction, inventory reduction, China buying—have yet to materialize.

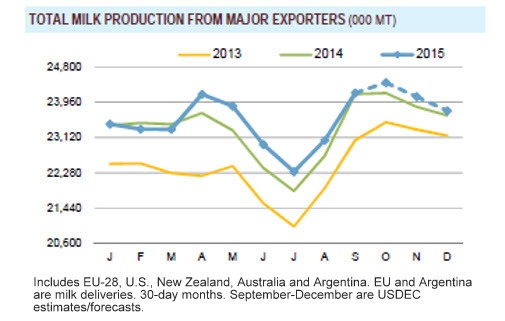

From April to August, milk production from the top five exporters (EU-28, United States, New Zealand, Australia and Argentina) was up 2.1 percent vs. the prior year—nearly 500,000 tons of additional milk per month. September production, on the other hand, is estimated to be up only fractionally, but it will take many more months of flat or declining output to rebalance the market.

In the third quarter, milk deliveries in Ireland and the Netherlands were up 14 percent and 10 percent, respectively. This more than offset a 4 percent decline in production in New Zealand. Australia milk production this year is up 8.3 percent from two years ago, but output was up less than 1 percent in September, as hot, dry weather is impacting productivity.

We expect production from the Top 5 to be up about 1 percent in Q4 and Q1-2016, then retreat to -1 percent in Q2-2016 as lower farm-gate margins continue to bite.

Heavy milk powder stocks throughout the world will continue to be a drag until they’re worked through. In Europe, offers to invention have wound down, but industry SMP inventories are estimated to be about 275,000 tons, double the desired level. In addition, more than 100,000 tons of butter and cheese are still sitting in PSA. In the United States, commercial inventories of NDM, cheese and butter this summer were about 100,000 tons more than the usual summer peak. New Zealand suppliers are believed to have inventory scattered in various places: in local warehouses, in markets, with distributors, in subsidiary offices all over the globe. And pipelines are quite full in China and other importing markets.

China imports have leveled off, and were actually above year-ago levels in many categories in September, including record purchases of fluid milk and infant formula. But last year’s imports were severely depressed, and critical milk powder purchases are typically the lightest in Q3, so September imports aren’t necessarily indicative of a shift in the prevailing trend.

Under the China-New Zealand FTA, China can import about 140,000 mt of WMP under preferential duty (2.5 percent tariff vs. normal 10 percent tariff) in 2016. Typically orders pick up in November and December to capitalize on these rates.

In the first half of the year, global dairy trade, excluding China and Russia, was up more than 10 percent. Key importers, including Mexico, Japan, Malaysia, Egypt and the Philippines have all posted double-digit growth in 2015. Venezuela hasn’t published official import numbers, but WMP exports to Venezuela from major suppliers were up 42 percent in the first three quarters of the year.

As impressive as these figures are, it appears most users stocked up on historically low prices and are now well covered into 2016. Therefore, there is less need to buy aggressively.

Among key suppliers, the EU and Australia have been the most aggressive in recent months. In the June-August period, EU exports of milk powder, cheese, butterfat and whey were up 10 percent. Australia exports were up 17 percent, while New Zealand exports were flat and the United States was down 20 percent.

We maintain our view that the global markets, particularly for milk powder and whey-based ingredients, will not move into better balance before the middle of next year. At the closely watched GDT auction on Nov. 3, prices decreased for the second straight time, after gaining 56 percent in the previous four events. As a signal of current market sentiment, WMP averaged $2453/ton and SMP averaged $2018/ton. NZX futures for WMP average $2400/ton for H1-2016.

Buyers’ pipelines are well filled and they have little urgency to bid prices higher. De-stocking must take place, and we expect that to be a gradual process. We look for prices to roll back further in the months ahead and stay relatively depressed, with some periodic fluctuations reflecting market uncertainty and strategic buying.

Subscribe to the U.S. Dairy Exporter Blog

The U.S. Dairy Export Council fosters collaborative industry partnerships with processors, trading companies and others to enhance global demand for U.S. dairy products and ingredients. USDEC is primarily supported by Dairy Management Inc.through the dairy farmer checkoff.