Market Watch Diary: An Unsustainable Relationship

When the cheese market crashed by more than 40¢ in August, it barely registered on the 2012 outlook. Class III futures for the first half of next year averaged $17.01 on the first day of the month, $17.04 on the last.

When the cheese market crashed by more than 40¢ in August, it barely registered on the 2012 outlook. Class III futures for the first half of next year averaged $17.01 on the first day of the month, $17.04 on the last.

There was a time not long ago when having $17 milk in the first half of the year would be like holding a winning lottery ticket. Not so today, when corn futures are pushing $8 per bushel and decent alfalfa in some places tops $300 per ton.

In short, this is not a sustainable relationship. Even in red-ink-laden 2009, the ratio of Class III milk to corn was about 3 to 1. Next year, it’s shaping up to be closer to 2 to 1. My records go back more than 40 years, and in all that time it’s never been that low.

Bonus Contact |

| CME Group Corn futures |

There are a couple of possible ways this could play out. It could go the way it did a year ago. Last fall, corn prices took off, rising roughly 40% in the second half of the year. Milk futures were slow to follow, but eventually they did. Futures for 2011 languished around $14 to $15 for most of the fourth quarter, then rallied in December, climbing $3 to $5 in a matter of months.

The trouble is, U.S. prices are somewhat capped by what global buyers are willing to pay and by what our overseas competitors are willing to take. For now, buyers are getting what they need without having to bid prices higher.

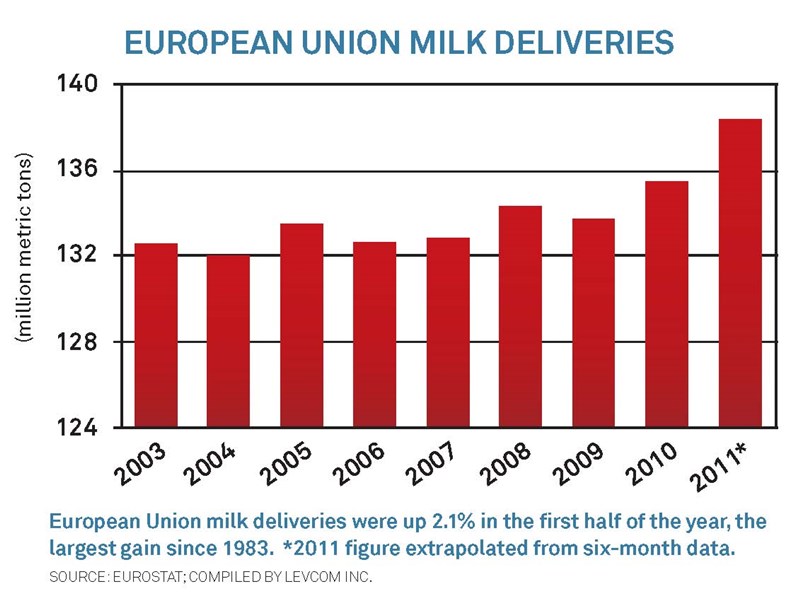

And global supply is coming on like a torrent. New Zealand farmers are poised for record production in the upcoming season, Argentina is seeing double-digit growth and output in Europe was up more than 2% in the first half. That’s the largest European increase since the quota regime was introduced nearly 30 years ago.

We’re betting (hoping?) the world market will need product so badly that buyers will bid prices higher to keep our supply flowing. And that’s possible. But if they don’t, U.S. production is going to shrink enough to short the market.

With the cost of production where it’s likely to be next year, we’re going to have to have at least $20 milk to maintain supply. The big question, then, is whether the price goes up before a couple hundred thousand cows go to the slaughterhouse, or after.