World Markets Finely Balanced

Dairy commodity prices were steady as 2011 came to a close. Global demand was surprisingly resilient in the fourth quarter.

Dairy commodity prices were steady as 2011 came to a close. Global demand was surprisingly resilient in the fourth quarter.

Even with world milk production up nearly 3% in 2011 and the promise of a tremendous flush in New Zealand, consumption was generally strong enough to absorb the onslaught. There was little evidence of burdensome inventory buildup heading into the new year.

China’s purchasing slowed in the second half of 2011, but November imports were improved. Throughout the year, imports from Southeast Asia (led by Indonesia and Thailand), the Middle East/North Africa (led by Algeria), Mexico, Japan and South Korea were strong, despite higher global prices. This reflects emerging markets’ ability and willingness to pay more for dairy, and protein in general.

But we aren’t out of the woods yet. Further price erosion could occur in the first quarter after buyers assess their year-end inventory positions. In addition, China dairy imports were up about 40% in the first four months of 2011. Will the Chinese be able to improve on (or even repeat) that level of buying in 2012?

In late December, international prices were around $1.80 for cheese, $1.70 for butter and $1.55 for skim milk powder. Global prices will put a ceiling on U.S. prices, which have generally run 15¢ to 25¢ below international levels in recent years.

Bonus Content: USDA Dry Whey Reports

Those prices are good by historical standards, but won’t be enough to cover the "new normal" in feed costs. If world prices don’t improve, U.S. farm profitability will be squeezed in the months ahead.

In fact, we’re already seeing U.S. dairy producers pull on the reins. Cow numbers shrunk in November for the first time in more than a year, and culling activity is the highest since 1996.

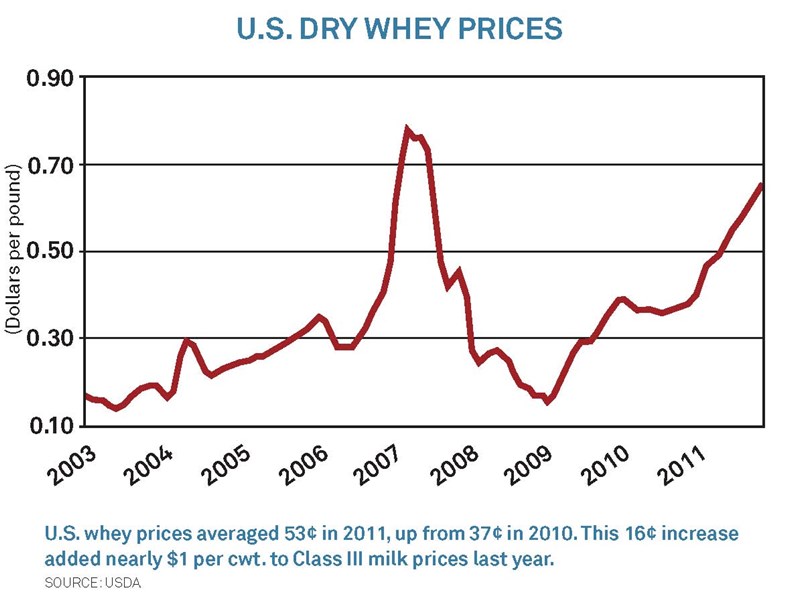

Through it all, the survival of many dairy producers in 2012 may rely on the continued strength of the dry whey market. The steady run-up in whey over the last year has put millions of dollars in the pockets of dairy producers in the Federal Orders (though just a fraction of that in California).

Four years ago, when the dry whey price rallied above 75¢ per pound, buyers abruptly walked away and the market crashed. Supplies are remarkably tight now, but it remains to be seen if whey demand will be more sustainable in 2012.