California Ag Secretary Seeks Help for State’s Dairy Producers

Ross suggests modifying FARRM Act with a feed cost amendment, which could give California dairy producers an added $1 per cwt.

Source: Western United Dairymen Weekly Update

Karen Ross, California Department of Food and Agriculture Secretary, this week wrote to members of the California Congressional delegation urging they take action to ensure that “appropriate disaster assistance is available for our farmers” in light of the record-breaking drought that’s impacting Midwest corn and grain producers and leading to increased feed costs for California farmers.

Ross said the USDA’s designation of nearly two-thirds of the U.S. as drought disaster counties as well as the disaster aid bill passed by the House do not address the “disastrous impacts the drought is having upon California farmers.”

She urged passage of the farm bill but she acknowledged the political roadblocks it faces in the House and suggested two options. One is a program that appropriates 30% of annual custom receipts at the USDA Secretary’s discretion to assist farmers. In the past these funds have been used to pay for ag disaster relief, Ross said.

The other avenue, she said, would be passage of a modified version of the Retroactive Margin Insurance program in the Federal Agriculture Reform and Risk Management Act (FARRM). Ross said the program should be adjusted by “adding a provision giving dairy producers the option of calculating average feed costs based on prices in the top ten milk producing states rather than on a national average. This modification is necessary to address the effects that this could have on the supply of milk. The loss of significant production capacity would have a devastating effect throughout the U.S.”

Ross also recommended that the proposal be backdated to the expiration of the Milk Income Loss Program to prevent any gap in assistance.

Over the last three years, Western United Dairymen (WUD), a California trade organization, has been working to analyze national dairy policy and advocate for programs that would be of meaningful assistance to California dairy families.

“Our focus is to protect California’s interests, not the Midwest’s,” said CEO Michael Marsh.

WUD says it repeatedly has reiterated the importance of getting the policy right by including feed costs that are relevant to dairymen.

“At no other time than now, where feed prices have skyrocketed beyond expectations, is the importance of the feed cost so apparent,” WUD notes in its Sept. 14 Weekly Update. “For the margin insurance to be effective, it has to pay out when dairymen need it. And with feed prices being the culprit behind today’s difficult financial situation, you need that reality reflected in margin insurance payments. If feed prices in the formula reflect the cheaper feed costs in the Corn Belt, that’s great for a Wisconsin producer, but not if you are in California. We need a program that is fair to California dairymen, one that speaks closer to their reality.”

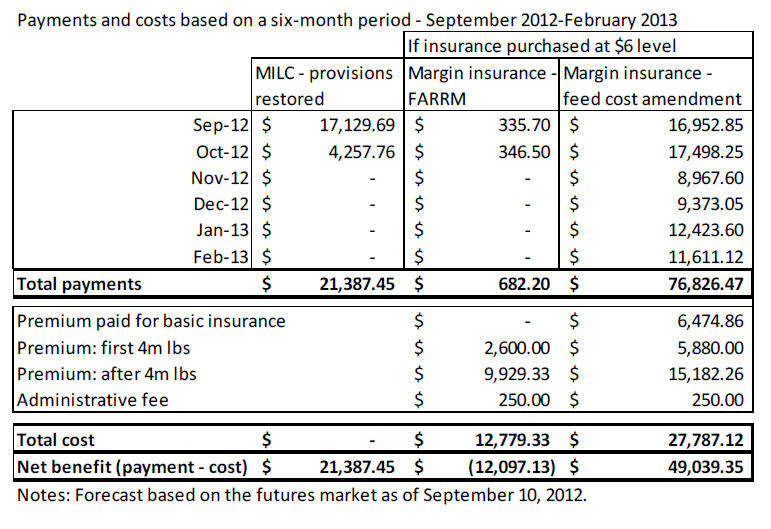

WUD’s analysis of the “Top ten dairy state feed cost calculation amendment” (feed cost amendment) shows that it would be the best option for California dairy families. Looking at projected margins from September 2012 to February 2013, the feed cost amendment could generate $76,826 for a 1,000 cow dairy while the current language in the House of Representatives’ Farm Bill (FARRM) could generate $682.

The higher forecasted payments in the feed cost amendment stem from the different data used to calculate the feed costs. Using the feed cost amendment generates a feed cost that is on average about $1 per cwt. higher, which triggers payments sooner, when dairymen need it, WUD says.

If MILC was to be reauthorized with last year’s parameters, it could generate $21,387 for the same dairy.

Using the feed cost amendment would clearly be a benefit to California dairy families. WUD says that’s why it, California Dairies, Inc. and Secretary Ross support the concept actively.

The cost to participate in the margin insurance outlined in the feed cost amendment is slightly higher (dairymen would have to pay a premium to participate in the basic margin insurance while under FARRM it is free), but the benefits are clearly superior, WUD notes.

The chart outlines the differences between the three programs for a period of six months. The calculations were made assuming a 1,000 cow dairy produced the same milk per cow as the corresponding months of the previous year. Supplemental insurance was purchased to cover 90% of the milk, which is the maximum allowed under both margin insurance programs. For MILC, no payments were made after October because the maximum pounds allowed (2.985 million pounds) would cover September and part of October’s volume only in this example.

|