Better Yields and Improved Crop Prices Propel Ag Economists' Outlooks for 2024

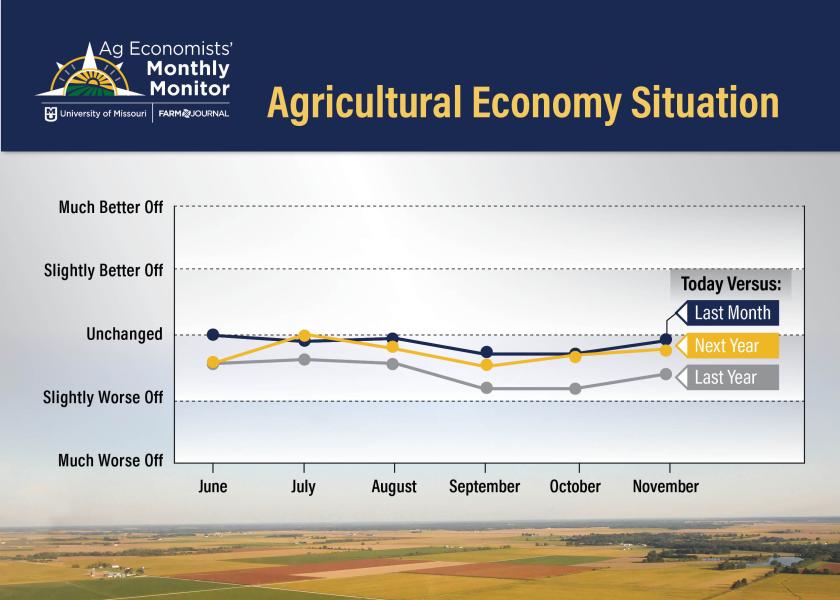

After two months of a waning outlook on the ag economy, economists' views took a turn in the November Ag Economists’ Monthly Monitor, a survey of nearly 70 ag economists from across the country.

“The biggest takeaway I see out of the Monthly Monitor this month is we're seeing a lot more positives than we've seen for the last couple of months,” says Scott Brown, the interim director for the Rural and Farm Finance Policy Analysis Center (RaFF) at the University of Missouri, who also helps author the Ag Economists’ Monthly Monitor.

The Ag Economists’ Monthly Monitor is conducted by the University of Missouri and Farm Journal each month, as it’s a way to gauge not only the state of the ag economy but also explore the impacts of policy and trade. Brown says as commodity prices have seen some momentum, outlooks among economists are also shifting more positively for 2024.

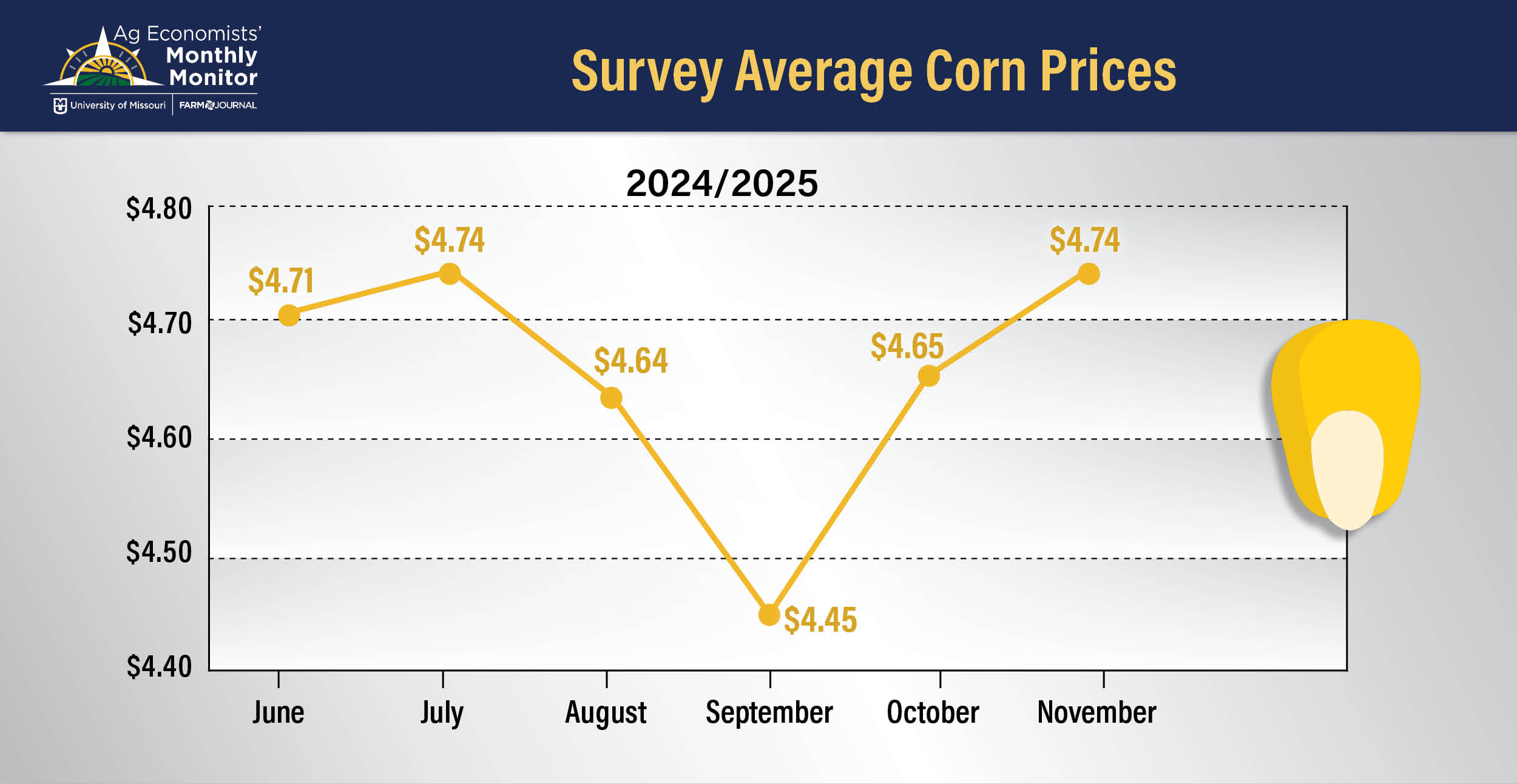

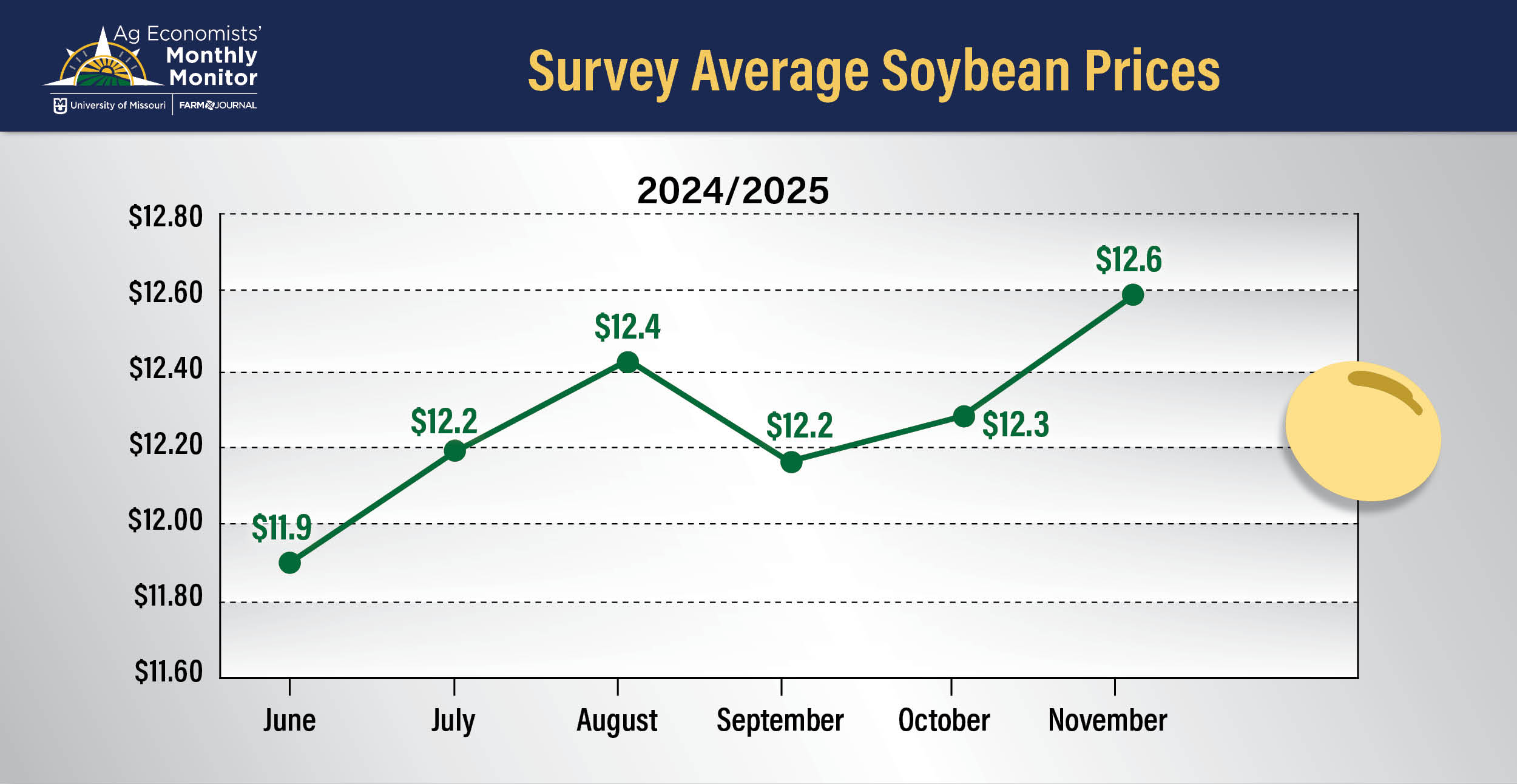

“I think when you look at where we are in terms of our estimates for crop prices, and we're talking about crop prices for harvest next fall at this point, we saw a number of more positive responses, maybe the most positivity since we started our estimates for 2024/2025. As both corn and soybeans continue to move higher, there’s more positive news this month,” Brown adds.

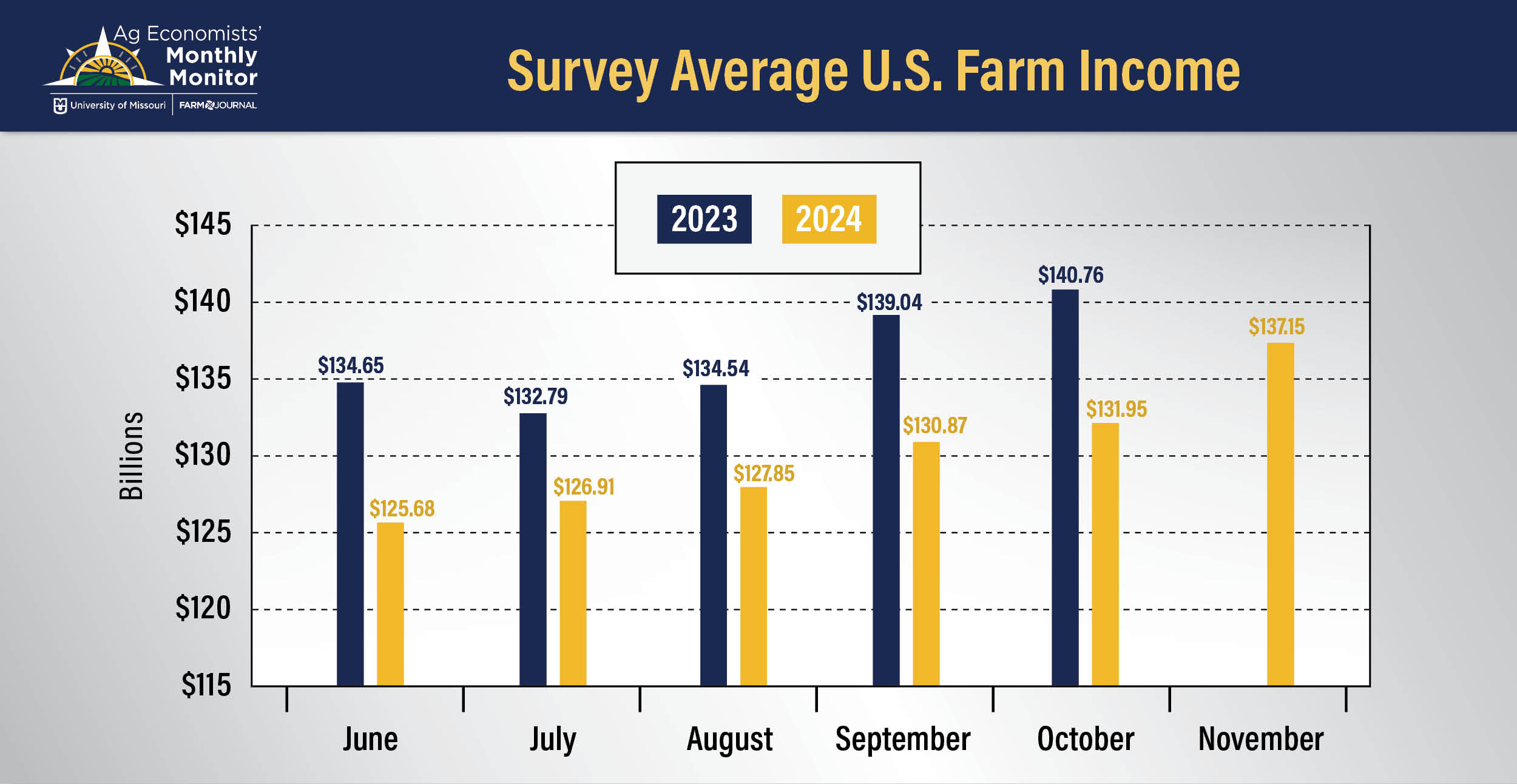

Spike in 2024 Net Farm Income Forecasts

That positivity also boosted net farm income estimates. The November Monthly Monitor asked ag economists to provide their outlook for net farm income in 2024. The survey found ag economists now expect a big spike in net farm income forecasts for the new year.

“Farm income estimates were raised almost $5 billion for 2024, relative to what they would have said in October,” Brown says. “And I think that just resonates as you look at higher estimates of corn prices and higher estimates of soybean prices, things just look a little better than where we were a couple of months ago.”

What’s driving improved outlooks in the farm economy? Economists say commodity prices, including improved yields and harvest picture for some commodities.

Another major factor is South America. When asked what factors will impact crop prices in the next six months, economists say:

- South American crop production (including weather impacts on planted acres) and related export sales.

- Global dynamics in general, as well as conditions and production in key regions like the Black Sea and China.

- U.S. export demand strength and growing crop supplies.

- Final U.S. crop size and weather-related impacts.

Weather Worries in South America

The latest USDA report pegged Brazil’s corn production at 129 million metric tons, but according to the Monthly Monitor, that estimate may be too optimistic.

“Our survey of the economist would have suggested 126.5 mmt right now,” Brown says. We did have some answering very near that 129 mmt and others saying 125 mmt. It's a combination of weather as well as economics, not all that great. That is leading to some lower estimates.”

When asked what’s driving changes in the crop forecasts for Brazil and Argentina? Economists say it’s all about weather, the impacts of El Nino and delayed planting that could eat into the Safrinha corn crop in Brazil. Economists also say Brazil could be looking at fewer soybean acres.

“Uncertain, volatile weather conditions - either too wet or too dry as Brazil transitions from La Nina to El Nino weather patterns,” says one economist when asked what are the factors driving the change in estimates for the Brazilian soybean crop. “Plus, delayed plantings of the 2024 Brazilian Soybean crop with substantial replantings required is hurting production potential.”

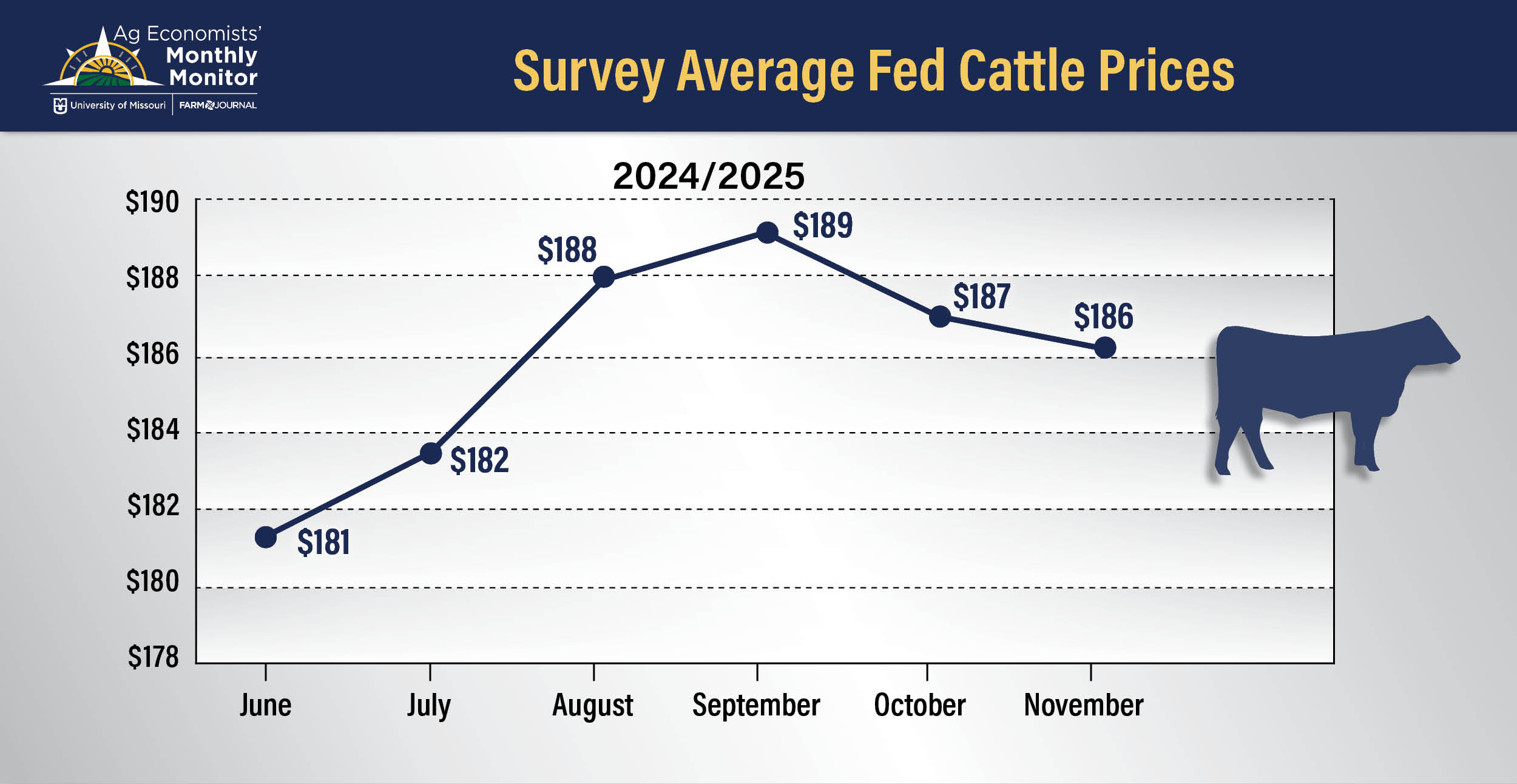

Bullish Views on Cattle Continue

While views on crop prices turned more positive in the latest Monthly Monitor, economists are still bullish longer-term on cattle.

“I think folks are more positive still on the cattle side of the equation, despite what's been the last few weeks of some lower cattle prices,” Brown says. “We are talking about an industry that continues to talk about record or near record, and perhaps in early 2024, we get back to record prices yet again.”

The outlook for pork prices, as well as dairy, continued to see some pressure, but overall, the factors economists think will impact livestock prices over the next six months include:

- Weaker demand domestically and globally.

- Global economic health, including slowdown/recession in some geographies.

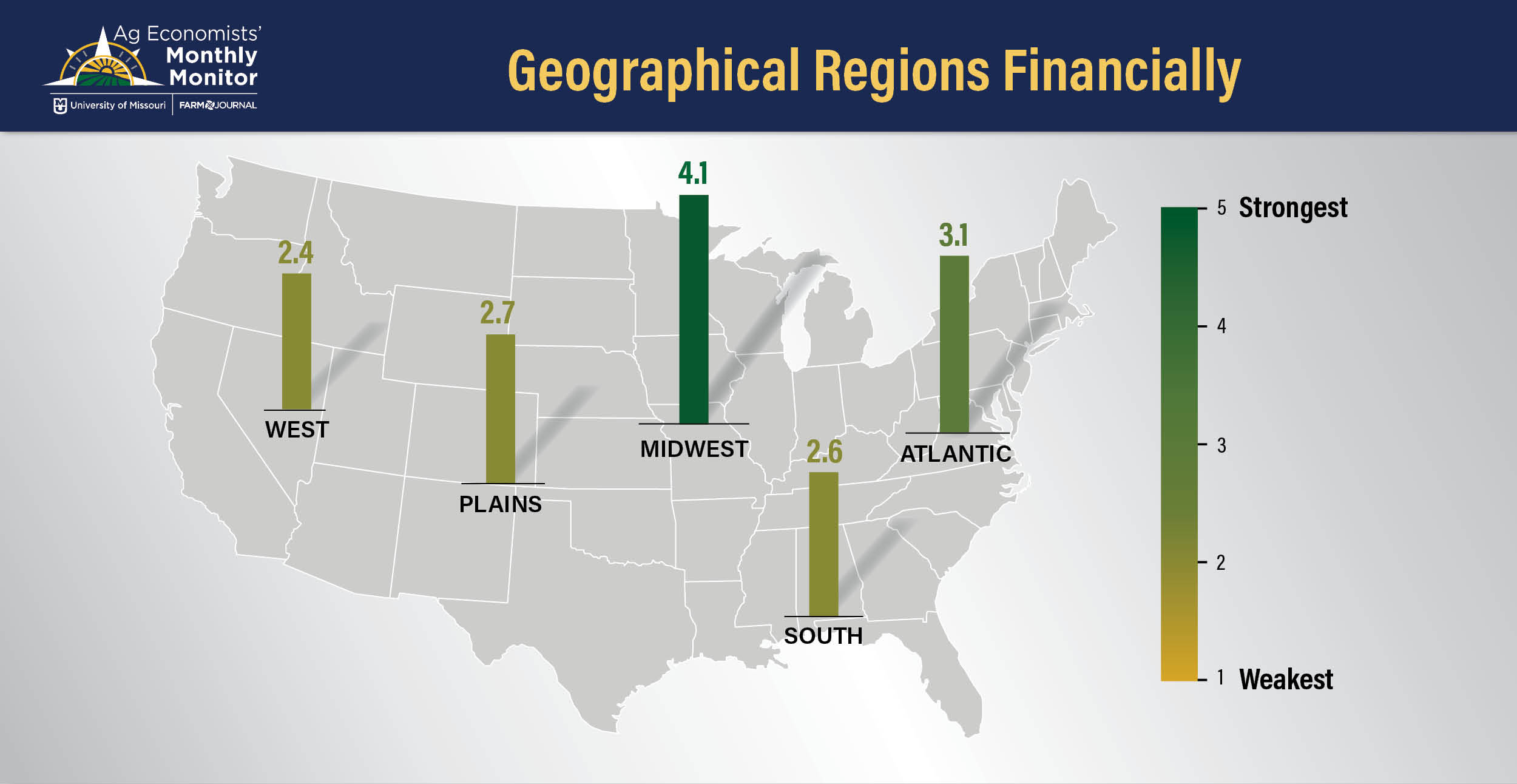

Health of the Farm Economy by Geography

This month’s survey also asked ag economists to rank the health of the farm economy by geography. The strongest region of the country, according to economists survey, is the Midwest.

“I think we ended up with especially better corn yields than anybody would have thought. Maybe soybean yields are not even as bad as some would have suggested. And then again, cattle still being very positive there, Brown says.

According to economists surveyed, there were a multitude of factors that played into how they ranked each geography, including:

- Drought and weather

- Government policy impacts upon state and metropolitan economic health.

- Commodity /crop mix

“Certainly, crop and livestock mix is important,” says one economist in the anonymous survey. “While corn prices are lower the combination of yields and prices were likely profitable for many. But lower prices have come on the heels of very high prices in the last couple of years. Hog and dairy returns are dragging down financial health in the sector regionally. Cattle prices are boosting overall returns in the Plains. But drought has certainly hurt ranchers, including water in the West.

Impact of Interest Rates (Both Positive and Negative)

Economists are still concerned about how interest rates could negatively impact agriculture over the next 12 months, but for the first time, economists now view it as a possible positive over the next year.

When asked, “What do you view as the most negative aspect regarding the outlook of U.S. agriculture?”, the Monthly Monitor shows:

- High interest rates, market volatility and a shortage of working capital create a challenging economic climate.

- Production challenges range from weather conditions to commodity prices and policy support.

- A need for investment into increasing domestic and demand for U.S. products.

When followed up with, what do you view as the most positive aspect regarding the outlook of U.S. agriculture, economists say:

- Economic resiliency of the farm operator, including strong financial positions for some operators and farm income forecasts remaining above the long-term average. Some optimism for stabilizing interest rates.

- Promising new demand opportunities, including the expansion of biofuel uses, as well as continued consumer demand.

- Improvements in technology and the possibility of better production in 2024.

“The news that we seem to be getting right now is, although inflation is still a problem, maybe less so than we would have thought. So perhaps we're getting near the end of interest rate increases, I even see some out there suggesting we could get lower interest rates as we get into 2024,” Brown says.

Outlook for Crop Mix in 2024

Economists were also asked to shift their focus to 2024. Economists say the most important factors that could affect 2024 crop plantings/acres in the U.S. are:

- Spring 2024 weather conditions and drought concerns.

- Corn-soybean price ratio affecting decisions, as well as planting prospects for corn/soybeans/cotton and wheat profitability.

- Changes in output prices, higher input costs, crop insurance price levels and 2024 futures prices affecting planting decisions.

- South American crop production and demand (domestically and globally) impacting prices.