From a Recession in China to $4 Corn, Here Are 10 Potential Surprises Ag Economists Say Could Impact Agriculture in 2024

From the election to world trade, as well as geopolitical factors that have the potential to shape agriculture in 2024, ag economists think the coming year is poised for several possible surprises that could have a direct impact on farmers across the U.S.

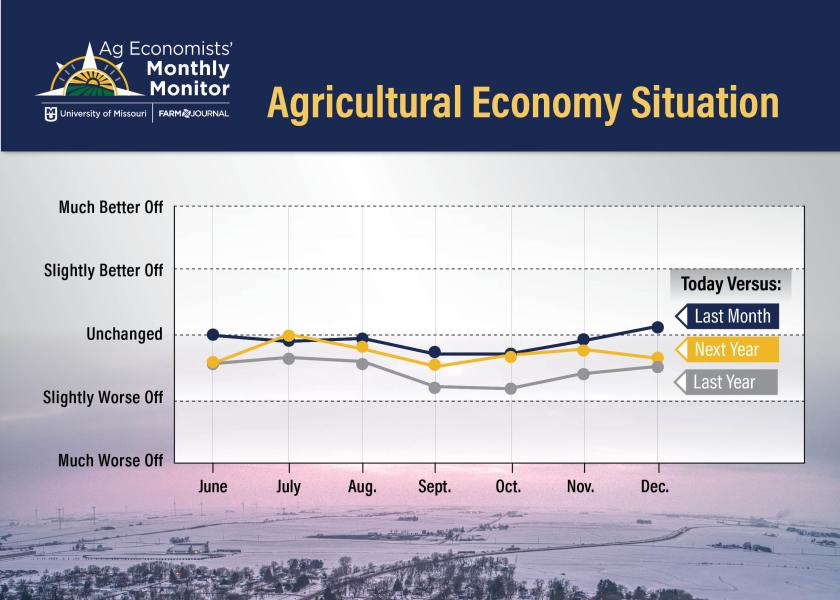

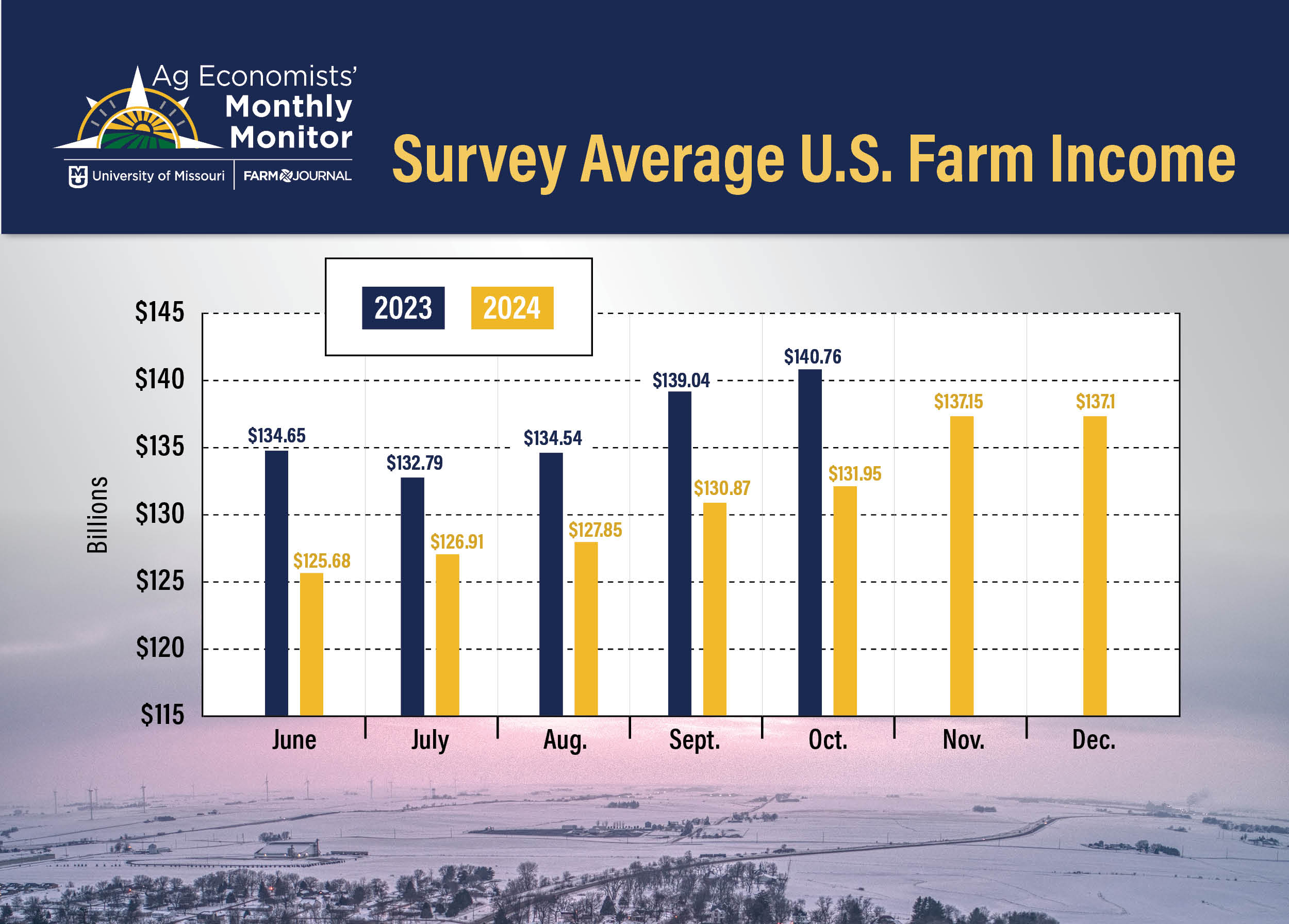

The December Ag Economists’ Monthly Monitor, a survey conducted by University of Missouri and Farm Journal, shows economists' views on the ag economy are slightly more positive compared with the past month. While expectations about 2024 net farm income remained steady, ag economists' outlook for the year ahead grew slightly more pessimistic.

Nearly 70 ag economists are invited to participate in the survey each month. When asked the two most important factors driving agriculture’s economic health today, as well as over the next 12 months, views were mixed.

“Macroeconomic influences, including persistent interest rate pressure and dollar value,” responded one economist in the anonymous survey.

“Declining prices for most major commodities reducing receipts and tightening margins despite some input prices retreating,” said another economist. “There is also some concern about multiple years of lower net farm income beginning to weaken relatively strong farm financial positions.”

“Macroeconomic influences, like interest rates and dollar value, and the impact of funds positions in the commodities markets are impacting the current environment,” was another response from the survey. “There's been some improvement in recent months, but farmers are still facing relatively high costs and low commodity prices resulting in tight margins. Over the next 12 months, I marked unchanged for state of the ag economy on the expectation for continued improvement in macro influences and margins, but also multiple years of lower net income environment beginning to weaken the strong farm financial positions of the past few years.”

Expect the Unexpected

Looking ahead at 2024, economists in the December Ag Economists’ Monthly Monitor were asked, “What unexpected news headline would you not be surprised to read in 2024?” Ag economists said:

- China falls into big recession.

- A second extension of the farm bill.

- Corn prices test $4 again.

- Inflation supports managed money returning to the commodities again.

- World ends, poor hurt worst.

- Record beef imports in 2023.

- National corn yield >190 bpa; U.S. embargoes ag exports to China.

- End to Russia/Ukraine war bumps global food grain supplies and cuts prices.

- 2024 planted acres across all crops similar to 2023.

- Economic woes unfold for U.S. agriculture as input costs remain high and farm prices falter.

What Shaped Crop and Livestock Prices in 2023?

When asked the biggest event or factor that impacted crop prices in 2023, ag economists said it’s all about supply and demand, sprinkled in with impacts from the strong U.S. dollar. They said:

- Large corn acreage and rebound in the U.S. corn crop, despite weather challenges.

- Build back of stocks levels globally for crops, including exports from Brazil, Russia and other key areas.

- Price retreat based on weak demand and rebounding yields; also higher interest rates contributing to stronger dollar and weaker demand.

For livestock prices, ag economists say 2023 was more about cow numbers.

- Low beef cow inventory due to continuing effects of weather challenges and economics supporting high prices.

- Price pressure among other livestock commodities.

2024: Biggest Economic Concerns

Ag economists were also asked to look ahead at 2024. When asked what they are most concerned about when it comes to the ag economy, geopolitical issues and the U.S. presidential election rose to the top of their concerns, including:

- Geopolitical factors, including war and disruption, global competition and other potential disruptions.

- Domestic politics, including the 2024 election and policy detrimental to biofuels use, and government debt leading to rising interest rates and finance costs.

- Decline in commodity prices paired with increasing input and land costs, leading to squeeze in margins.

“Crop prices could fall further, adding to a price-cost squeeze for many crop producers. Such a development would, of course, tend to help the livestock sector. We could be entering a period where the fortunes of crop and livestock producers may diverge,” said one economist this month.

“South American competition as well as authoritarian governments in places like Argentina, the Netherlands and possibly the U.S.,” responded another economist.

Optimism for 2024

There is also optimism for the year ahead, which is sprouting from the possibility for continued improvement in drought as well as new areas of demand. Ag economists were asked what they’re most optimistic about when it comes to the ag economy, and economists surveyed said:

- Demand opportunities through domestic soybean crushing, renewable fuel, SAF and global oilseed.

- Robust domestic consumption and opportunity for competitive pricing of U.S. commodities in global markets.

- Improved farm-level conditions related to efficiency, moisture conditions and farm income above historical averages (if a recession is avoided and input costs come down); many ag producers still have a strong balance sheet.

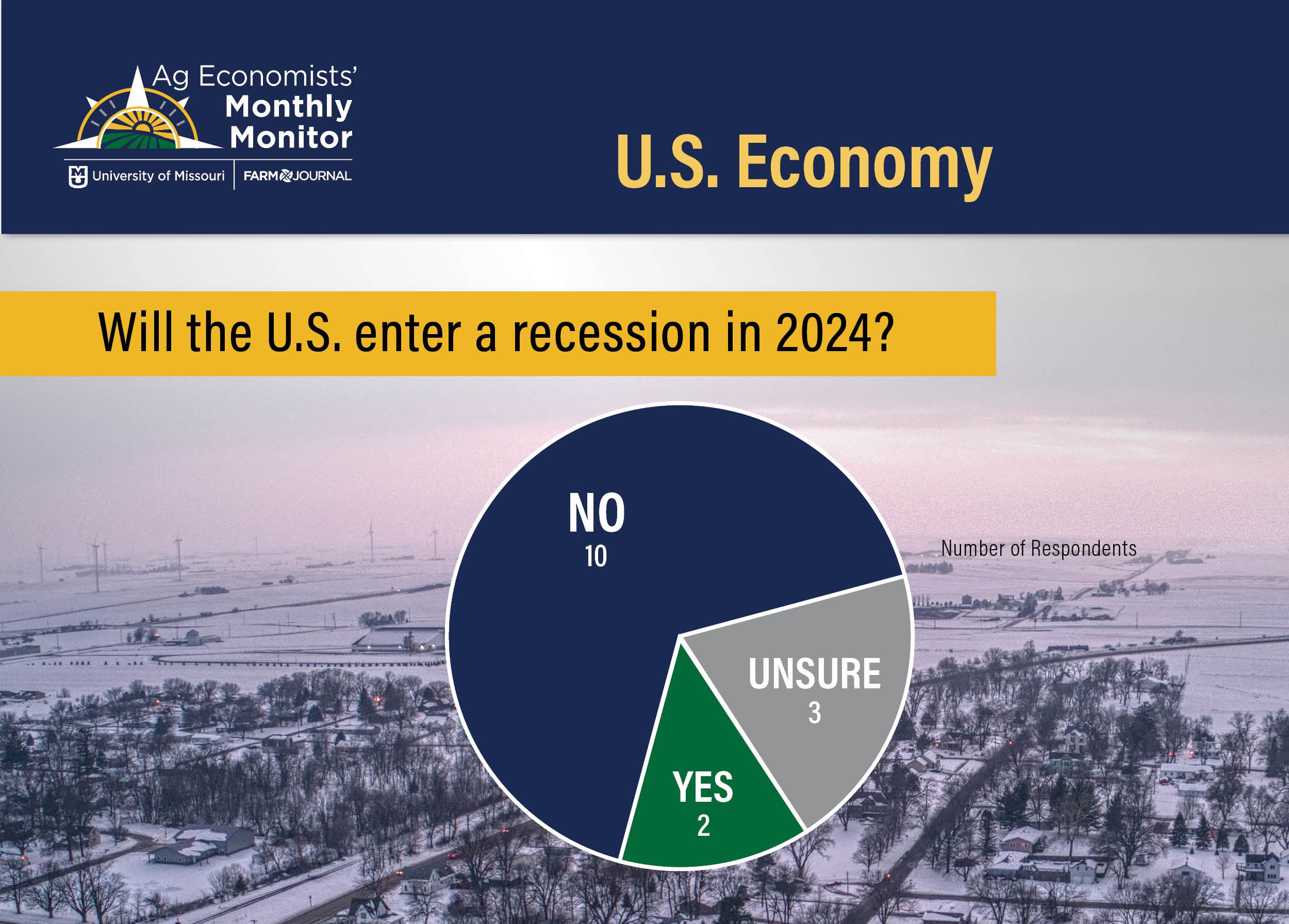

Recession or Soft Landing in 2024

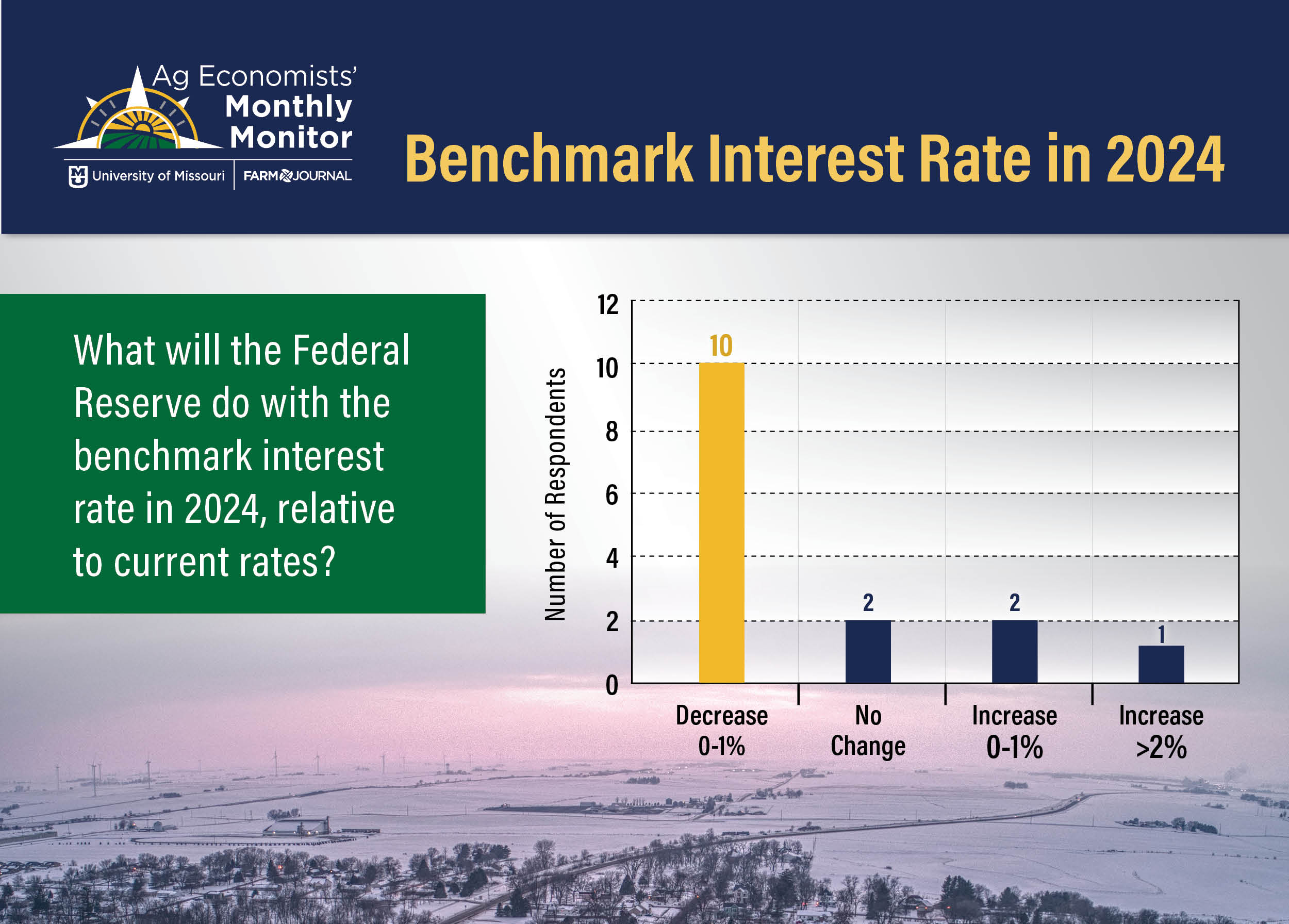

The U.S. avoided a recession in 2023, and majority of ag economists think the U.S. won’t enter a recession in 2024. After the Federal Reserve hinted toward interest rate cuts in 2024, some think there’s still a chance the country will see a slight increase in rates in 2024. The majority said they expect a 0% to 1% decline in interest rates in 2024.

While one economist warned of the impacts if the Fed were to start cutting rates too soon, economists point out the general economy has been resilient in spite of wars and inflation.

“It now looks like a fairly soft landing,” said one economist regarding the outlook for interest rates and whether the U.S. will enter into a recession next year.

“Some leading indicators continue to point toward recession, but so far, the economy has avoided recession. The December FOMC dot plot and post-meeting comments reiterate their efforts to guide the economy to a soft-landing,” said another economist

“There are certainly risks, but the odds of ‘muddling through’ appear to be rising,” said one economist in the survey. “With inflation declining, the Fed may be able to relax interest-rate policies in late 2024.”

However, not all economists are in the camp the Federal Reserve will cut interest rates next year.

“It may be a mild one if it occurs. If it doesn't occur, that will suggest risk of higher interest rates,” said another economist.

“There are a lot of mixed signals in the economy,” pointed out another economist. “GDP is growing, inflation is cooling off, low unemployment, growing stock market — all positive. Higher interest rates, credit card balances are negatives.”

View more results from the Ag Economists' Monthly Monitor here.