Hay Prices Could Increase Significantly

There is a strong correlation between corn prices and milk prices. In one of my previous articles, I wrote about the correlation and overlayed corn and milk price to show how closely these markets are related. It stands to reason that there is a strong correlation because corn is the main part of a dairy ration. As the price of corn increases, farmers have choices to make. They can feed less corn supplementing it with something else that might be less expensive and still provide the required nutrition for milk production. However, the replacement is generally not as good resulting in reduced, but acceptable milk production. Another choice is to cull cows to reduce the amount of corn being feed to lower producing animals thereby increasing efficiency and profitability while feeding the usual amount of corn. Another choice is to sell the cows and exit the dairy business if the farm cannot continue under current market conditions. Any of these choices may reduce overall milk production and tighten supply. This is what has been taking place in the market since last fall.

However, when we look at income over feed, it remains positive as milk price has increased keeping pace with increasing corn, soybean meal and premium/supreme hay prices. These are the prices used in calculating income over feed for the Dairy Margin Coverage program. I realize that feed prices can be significantly higher in some areas of the country because of the difference in cash prices for these commodities due to the need to rail or truck corn and soybean meal into deficit areas as well the cost of available dairy quality hay. But for the purpose of comparison, we use the average prices on the monthly Agricultural Prices report. The most recent income over feed price was $10.98, down from $11.54 in January. Both of these were the highest income over feed since November 2020 and indicates income over feed is historically good.

One component of income over feed is hay. Premium/supreme hay price is used in the calculation currently as it is more reflective of dairy quality hay. A blend of alfalfa hay and premium/supreme hay was used from January 2019 through December 2019. Prior to that the alfalfa hay price was used to calculate income over feed. The February alfalfa hay price was $214.00 per ton and not much different than it was in 2014 when we had five months of alfalfa price over $200.00 per ton and record high milk prices. Actually, current alfalfa hay prices are not too much higher than the past few years. The greater price change took place in premium/supreme quality hay. This price first began to be calculated in January 2019 with the first two year not showing a great deal of price fluctuation. However, that changed in 2021 as the drought had more of an impact on areas of the country affecting hay production and increased demand for hay resulting in significantly higher prices as seen in the chart below.

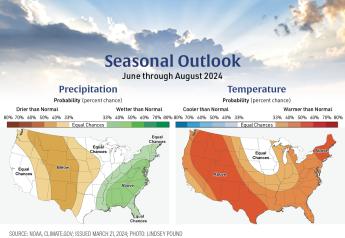

All hay stocks at the end of last year reached a ten-year low. The current drought monitor map indicates that it may not get any better unless the weather pattern changes. This could push hay prices and especially dairy quality hay prices significantly higher reducing income over feed cost.

Not only is income over feed a concern this year, but so are escalating costs for all other aspects for the dairy farm. Recent income over feed prices may indicate profitability in themselves, but other costs have increased cost of production substantially. What may look good on the Agricultural Prices report released at the end of the month does not mean it is profitable.

If just doing nothing is your marketing plan this year or any year, could result in many sleepless nights. Strategies need to be implemented to protect prices in any way possible. Feel free to call us if you need any help.

Robin Schmahl is a commodity broker with AgDairy, the dairy division of John Stewart & Associates Inc. (JSA). JSA is a full-service commodity brokerage firm based out of St. Joseph, MO. Robin’s office is located in Elkhart Lake, Wisconsin. Robin may be reached at 877-256-3253 or through the website www.agdairy.com.

The thoughts expressed and the basic data from which they are drawn are believed to be reliable but cannot be guaranteed. Any opinions expressed herein are subject to change without notice. Hypothetical or simulated performance results have certain inherent limitations. Simulated results do not represent actual trading. Simulated trading programs are subject to the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. There is risk of loss in trading commodity futures and options on futures. It may not be suitable for everyone. This material has been prepared by an employee or agent of JSA and is in the nature of a solicitation. By accepting this communication, you acknowledge and agree that you are not, and will not rely solely on this communication for making trading decisions.