A Reality Check: Can Dairy Demand Dodge a Recession?

From record-high gas and diesel prices on the road to a spike in the price Americans are paying for protein and produce, shoppers are seeing price spikes everywhere they go. The rapid rise in prices is now producing more warning signs of a possible recession.

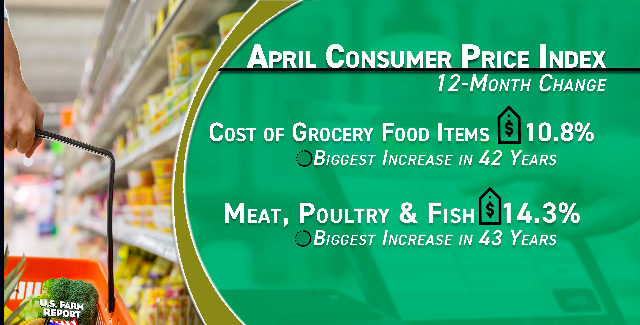

The latest Consumer Price Index (CPI) shows despite the overall pace of headline inflation easing, the cost of groceries alone increased 10.8 percent since April 2021, which is the largest annual increase in 42 years. The jump is being driven largely by the prices of meat, poultry and fish, up 14.3 percent in the past year, which marks the largest 12-month increase since 1979.

Dairy hasn’t been immune to inflation this year, with the CPI showing the price of dairy and related products rose 2.5%, the largest monthly increase since July 2007.

The broad inflation brush is also already impacting consumers and their purchasing decisions.

“Pessimism is pretty high with typical consumers as we speak,” says Glynn Tonsor, an agricultural economist with Kansas State University. “In the past, that can be a barometer for recession coming.”

Is a Recession Already Here?

Tonsor says consumer confidence isn’t the only measure of inflation, nor is it a sure sign a recession is imminent. Yet he points out if consumers start to taper their spending because they’re concerned, then it can cause what’s called a self-fulfilled recession.

“I think that's the most common narrative on the street now, in response to 6%, 8% inflation, depending who you ask. Consumers are tightening their belt, and maybe that will reduce demand for products enough that that induces a recession in 2023,” he says. That's not a guarantee. But we need to watch that, because the meat industry is very prone to consumer incomes.”

Impact on Dairy Demand

While concerns of a recession continue to hang over economic forecasts, history shows an economic pullback can have a direct impact on demand for products such as meat and dairy. However, the dairy case hasn’t historically seen as drastic of a hit, largely due to less competition compared to products like meat.

“I think I think there are some choices that have to be made,” says University of Missouri livestock economist Scott Brown. “Whenever we talk about costs rising for everything, in the case of dairy, I think about the buy down of restaurants that might occur as consumers go from higher priced restaurants to lower price restaurants. I think generally, that probably means less dairy. Just remember, this is all about the food away from home consumption, that I think it's important as we think about how Inflation affects consumer choice.”

While a recession could put a damper on demand, and in turn milk prices, inflation hasn’t taken a large bite out of either yet. However, the true test will be in the months ahead, and it could put any price forecasts on a detour as uncertainty mounts.

“My crystal ball for prices is cracked given just to all the uncertainty, but I will say I think there's an opportunity to keep prices higher for a period of time,” adds Brown. “For me, the biggest question becomes one of do consumers at some point turn away from some of the dairy products given that they are going to be higher priced. I don't know what the alternatives are, but to me, that's going to be the bigger issue.”

International Dairy Demand Remains Vital

Domestic demand has a stronghold on prices, but as the dairy sector continues to witness, international demand carries just as much weight.

“International trade still matters,” says Brown. “We could talk about China in terms of dairy products, perhaps there's a case where the fewer lock downs that we see happening going forward will be helpful to trade for U.S. dairy products. So, I think we can hold these prices, but growing them from where we sit today, I think, is pretty tough.”