Milk Powder and Whey Pace U.S. Dairy Exports in May

by Alan Levitt, U.S. Dairy Export Council

U.S. dairy exporters moved good volumes of nonfat dry milk/skim milk powder (NDM/SMP) and whey products in May, but struggled to maintain sales of other products. Suppliers shipped 175,355 tons of milk powders, cheese, butterfat, whey and lactose in May, down 6 percent from a year ago, and down 8 percent from April (daily average). Total overseas sales were valued at $500 million, down 26 percent from last year, and down 10 percent from April (daily average).

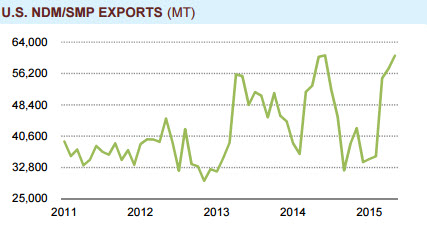

U.S. suppliers continued to clear milk powder into the world market to help manage record production and growing inventories. Exports of NDM/SMP were 60,622 tons, the second-highest total ever (daily average). This volume was up 2 percent from April (daily average) and up fractionally from last year. Sales to Southeast Asia—led by the Philippines and Indonesia—were 24,435 tons, a new high, and 30 percent more than a year ago. This offset a 25-percent drop in exports to Mexico. The average price of U.S. NDM/SMP exports was $2550/ton.

In the March-May period, U.S. NDM/SMP exports were equivalent to almost 59 percent of production. Even so, U.S. NDM inventories at the end of May were 118,000 tons, the most ever.

Whey exports increased for the fourth straight month. In May, total shipments were 48,251 tons, the second-highest total ever (daily average). This figure was up 9 percent from last year and up 4 percent from April (daily average). Shipments of whey protein isolate were a record high for the third straight month, more than doubling year-ago levels. This included a record 3,456 tons to China. Dry whey exports were the most in 11 months, though still 11 percent below last May. Exports of whey protein concentrate were up 19 percent from a year ago.

In contrast, U.S. exports of most other products were lower.

Cheese exports in May were 29,359 tons, down 8 percent from a year ago and down 10 percent from April (daily average). Suppliers sold 8,442 tons to Mexico, up 47% from last year. They also sold 2,715 tons to Australia, a new high. However, shipments to South Korea, Japan and the Middle East/North Africa region trailed last year’s pace. In all these markets, U.S. suppliers are losing share to suppliers from Europe, New Zealand and Australia, in large part due to higher U.S. prices.

Likewise, U.S. butter prices are not competitive with Europe and Oceania. U.S. butterfat exports were down 72 percent in May vs. a year ago. May volume – just 1,486 tons – was the lowest since August 2009. Among other products, whole milk powder (-45 percent vs. last year) and milk protein concentrate (-68 percent) continue to lag year-ago levels. WMP exports were the lowest since June 2013, while MPC volume was the lowest since December 2010.