Extending the Tax Cuts and Jobs Act is Good for American Farmers

The day-to-day work life of economists and farmers might look different, but both can agree on the following statements:

- The truth speaks for itself;

- Growth is desirable but requires a hospitable environment; and

- The nurturing benefits of tax relief and low, globally competitive tax rates created by the 2017 Tax Cuts and Jobs Act has had a pivotal, positive effect on our prosperity.

One of the most significant expenditures in a family farm’s budget is equipment. New John Deere combines cost more than $350,000, and a new John Deere cotton picker will set you back around $1 million. These must-have items feed the world while keeping our farms competitive in global markets.

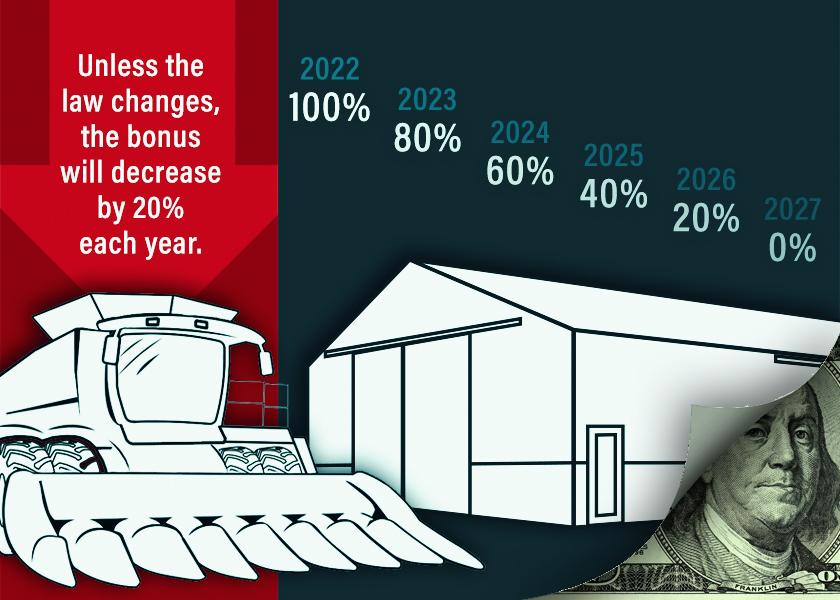

The Tax Cuts and Jobs Act included an important provision called “bonus depreciation,” which allows businesses to immediately take a deduction up to 100% of the cost of assets placed into service by the end of 2022. This provision made it easier for farmers to afford important and expensive purchases, just as it did for other businesses considering making productivity-enhancing investments.

Unfortunately, the percentage immediately deductible was reduced to 80% on Jan. 1, 2023, and will continue dropping by 20% each year until it reaches zero. The result will be that deductible amount is spread out over the life of the equipment, delaying when farmers (and other businesses) receive the tax offsets they might need to be able to buy the equipment.

For family farms, the ability to manage cash flow through this provision cannot be understated. The following hypothetical story outlines the benefits, not only to the farmer but also to the economy.

Farmer John is planting wheat. The price of his fertilizer has skyrocketed because of Russia’s war on Ukraine, but the price of the wheat he produces has also increased because Ukraine is a large global supplier of wheat. Farmer John will therefore make a profit from the wheat he produces, but doing so requires purchasing a new piece of equipment. In addition to making a profit, he can help offset the reduction in the global supply of wheat, which has contributed to increased prices for consumers at the grocery store. The purchase of his equipment will allow him to increase his yields, thereby increasing the supply of food on grocery store shelves across the country and around the world.

However, as Farmer John looks to the next growing season, he has doubts. Today, many are speculating that wheat prices might experience a significant drop next year. If prices go down, the profit Farmer John made this year could be eliminated next year because input costs are still high when he plants, but wheat prices might drop by harvest. It would be less beneficial for Farmer John to take an additional depreciation on his equipment, which was specifically used to support the higher output.

If you were Farmer John, would you invest in the new equipment?

The ability to fully depreciate the asset at the time of investment would align his cash flows, reducing uncertainty and making the investment more attractive. And we, the American people, want Farmer John to harvest more wheat when global supply is low. Yields directly affect grocery store prices, which supports the equipment manufacturers as well. This would be a net positive for our economy. By contrast, if he must spread out the deductions over time when he has considerable uncertainty about prices and optimal production, the investment becomes less attractive.

Although this story is fictional, it represents the challenges Miles Mendel, a South Dakota farmer, faces in today’s global economy.

“Volatility in the market is both a gift and a curse,” Mendel says. “We welcome the high prices we see, but we also know that our suppliers see those high prices and raise our inputs accordingly. However, when prices drop, the input cost decline is often much slower and creates huge problems for farms to remain profitable.”

Markets are dynamic. Our tax policy should reflect those dynamics and allow farm families to respond to volatility with flexible expensing policies such as bonus depreciation. Congress should extend this provision from the Tax Cuts and Jobs Act as it is long-term revenue neutral for the federal government and encourages timely investment in our economy. It is a win-win that both family farms and economists can be excited about.

Michael Faulkender is a former Assistant Secretary of the Treasury and Chief Economist at the America First Policy Institute.

Luke Lindberg is the President & CEO of South Dakota Trade and a Senior Fellow at the America First Policy Institute.