How Russia's Embargo of EU is Hurting U.S. Dairy Exports

By Alan Levitt, U.S. Dairy Export Council

Last month, Russia officially extended its ban on most dairy products from the European Union (EU), the United States, Australia and Norway through July 2016. The news was expected, given the political climate, but still disappointing in view of the embargo’s impact to date.

Russia’s ban, originally enacted in August 2014, has had little direct effect on U.S. dairy exports—we have not shipped significant quantities of dairy to Russia since 2010 due to a disagreement over certification. But its indirect impact on both the U.S. and world dairy sectors has been substantial.

The ban’s renewal is likely to prolong today’s global market imbalance and delay international commodity price recovery. It will, at best, continue to intensify U.S. overseas competition or, at worst, facilitate erosion of U.S. dairy export volumes and market share.

Some of the fallout of the ban is evident in production and trade data filed since its implementation.

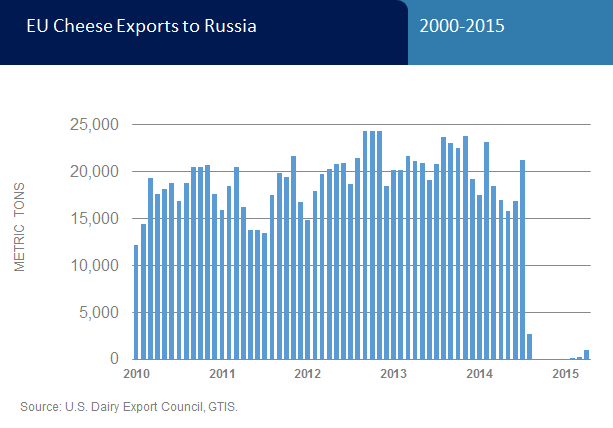

Prior to the embargo, Russia was the EU’s largest export market, taking about one-third of its cheese exports and one-fourth of its butterfat shipments. In all, Russia imports from the EU were the equivalent of about 2 percent of EU milk production.

For the first seven months of 2014, prior to the start of the embargo, EU dairy suppliers were exporting an average of 18,604 tons of cheese and 2,510 tons of butterfat per month to Russia. Since the embargo, the EU has had to find a new home for all that product.

With the loss of their biggest cheese customer, EU suppliers channeled rising milk production into skim milk powder (SMP) and butter. They aggressively (and successfully) pursued global SMP buyers, encroaching on recent U.S. milk powder success as well as expanding their existing customer base. The EU, for example, doubled its SMP export volume to the Middle East/North Africa, its largest powder market, to more than 278,000 tons in 2014, and added further 8 percent growth through the first four months of 2015.

EU shipments of SMP of Southeast Asia (Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam), the largest market for U.S. milk powder as recently as 2013, grew 27 percent to 143,337 tons in 2014 and were up another 27 percent through the first four months of this year.

EU butterfat exports to the Middle East/North Africa—far and away the largest U.S. butter buyer—jumped 70 percent to more than 45,000 tons in 2014 and were up more than 85 percent through the first four months of 2015. U.S. sales, in contrast, have shriveled.

The bloc even did a good job of finding new homes for its cheese. EU cheese sales to the top 3 U.S. markets—Mexico, South Korea and Japan—were up 228 percent, 151 percent and 61 percent, respectively, through the first four months of 2015, after sizable increases in 2014.

There was expectation that Russia would replace lost EU imports with cheese and butterfat from other regions and nations, like South America, India, Switzerland and others. And this in turn would create demand elsewhere in the world.

Some of those relationships never materialized. Other suppliers, like Argentina and Uruguay, did see a spike in Russian dairy shipments, but the volume gains paled in comparison to lost EU sales.

Russia is simply getting along with less in most product categories. Not counting what it’s getting from customs-partner Belarus, dairy imports for the first four months of 2015 were down more than 80 percent vs. January-April 2014.

With at least another year of the Russian embargo to go, the competition caused by displaced European products is likely to remain intense.

The U.S. Dairy Export Council is primarily supported by Dairy Management Inc. through the dairy farmer checkoff that builds on collaborative industry partnerships with processors, trading companies and others to build global demand for U.S. dairy products.