Best Advice on Locking in Milk Prices

In Elroy, Ariz., dairy producer Craig Caballero shares that risk management is a much-needed discussion and a much-needed ingredient to help manage his 5,200-cow dairy. Since 2007, Caballero has utilized risk management and says he could not imagine dairying without it.

“Risk management is a tool that we use every single day,” he says. “It’s part of what we do, and I personally could not imagine in the volatility that we live in, not participating in some kind of a plan.”

Caballero believes protecting both sides of the ledger is needed to help manage his dairy.

“I wouldn't call it risk management if you’re not handling both sides of the ledger,” Caballero says. “It’s more like speculating.”

Phil Plourd, president of Ever.Ag Insights, says that from a producer perspective, risk management decisions have gotten tougher in the past few months.

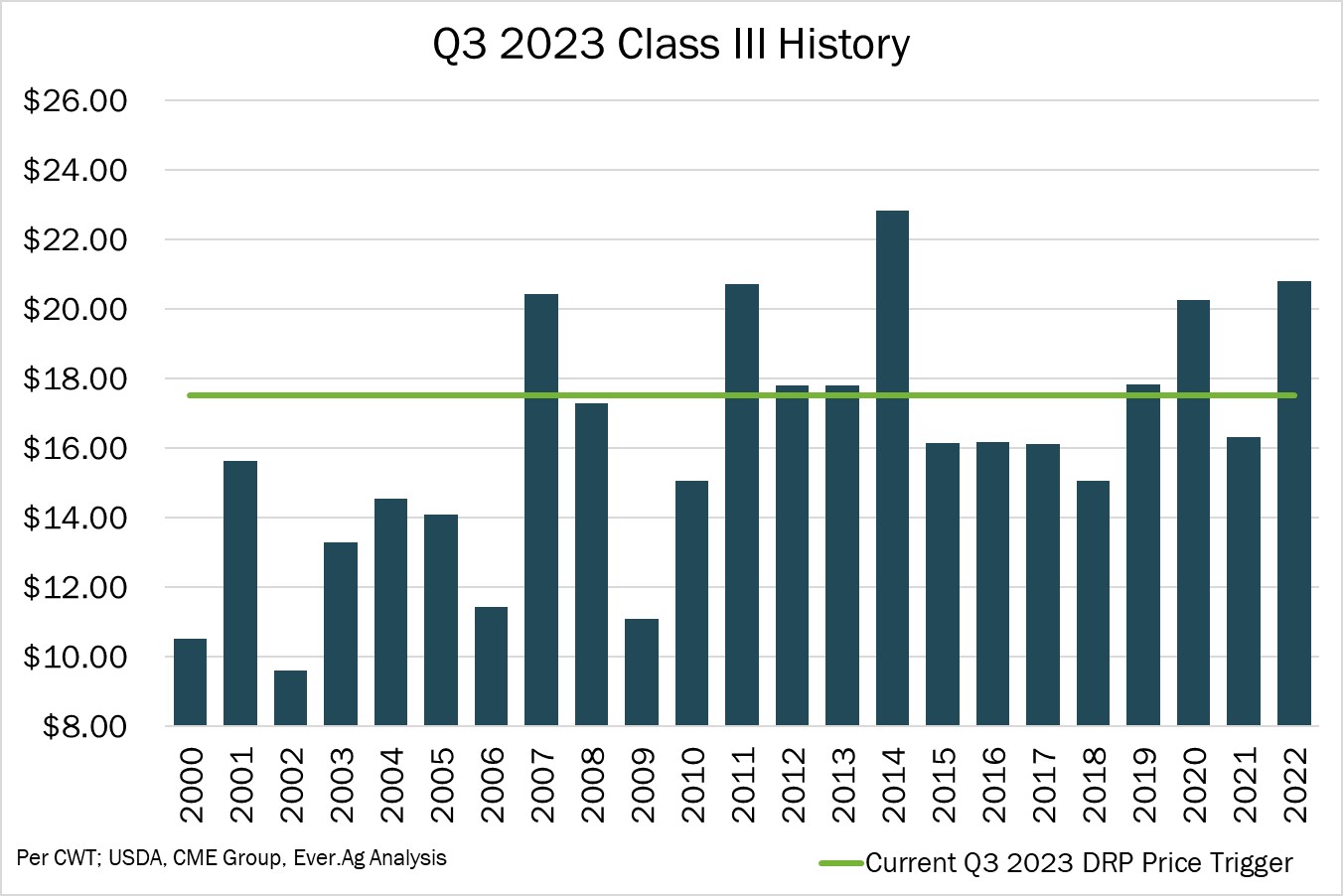

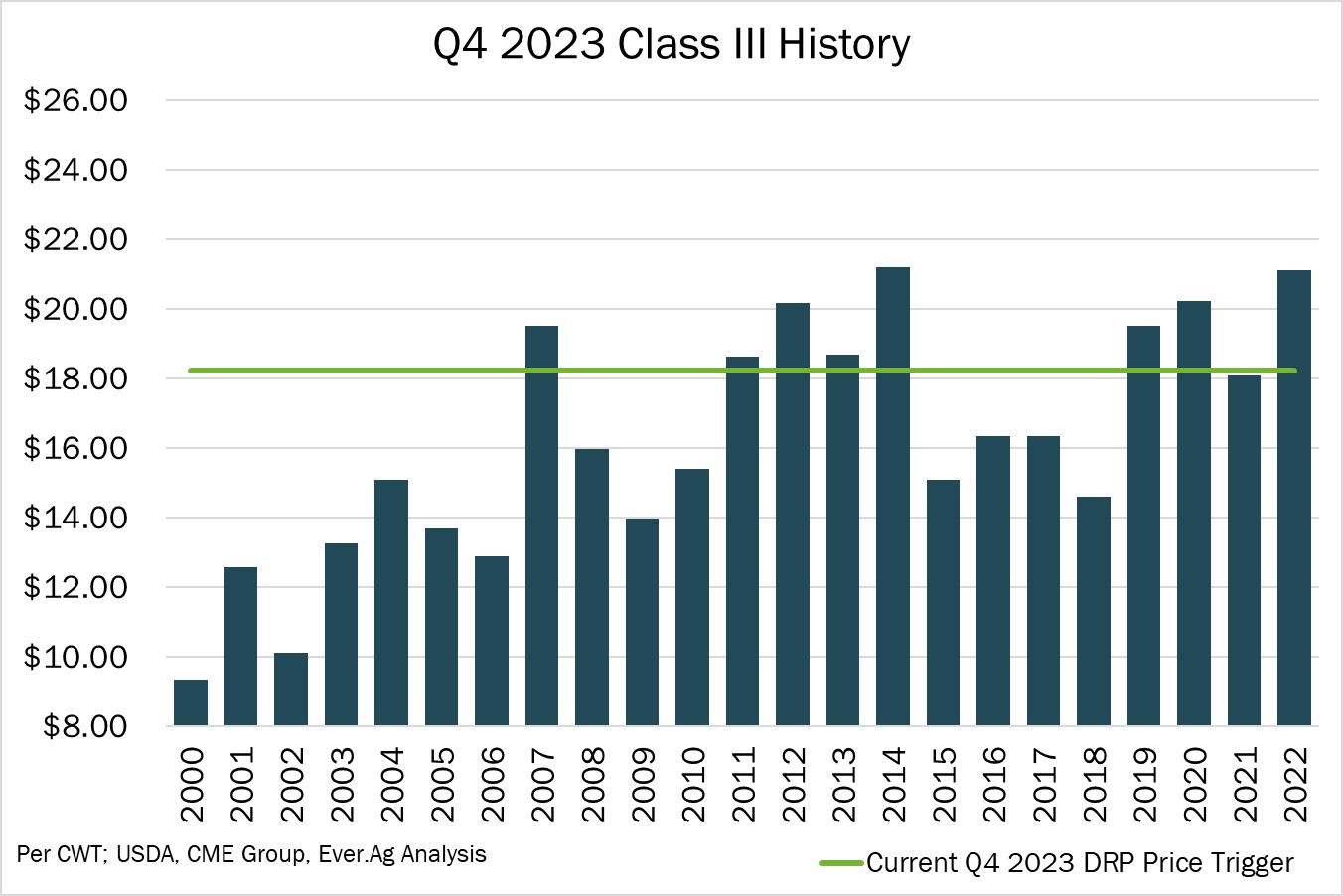

“On the one hand, we can look at third quarter Class III milk futures near $18.40 per hundredweight and fourth quarter pricing near $19.20 and say, ‘wow, that’s quite a bit better than the May price of $16.60!’. At the same time, for many and perhaps most producers, those prices are near or below production costs,” he says. “Most people get that second half 2023 prices could go lower – we’ve just seen it happen for Q2. But securing pricing that’s no better than production costs isn’t much fun.”

Penn State Extension offers the following guidelines to be considered in developing a personal marketing strategy for using milk futures:

- Don’t lock it all in. Set a minimum and maximum volume of milk to contract each month. If you are new to contracting or have low debt levels, consider less than 50% of monthly production. If you are more experienced and have a higher level of debt, consider a maximum volume of 60-80%.

- Don’t concentrate on near-term or far-off contract months. Given lags in the pricing system, worrying too much about contracting next month’s milk production does not make sense. Also, contracts nine months out and beyond are very uncertain. There aren’t many contracts traded for those outer months, so don’t concentrate on those either.

- Lock in more contracts as prices rise. You may decide to contract 30% of your future milk production today. If contract prices rise for that month in the days ahead, then contract an additional 20-30%. This method will allow you to average into a strong price. While you are doing that, don't forget about contracts that are four to eight months out. Those contract months typically do the best in making positive returns when short-term cash markets are rising because strong cash markets today have a positive effect on all contract months.